Financial Mistakes to Avoid

July 13, 2023

Managing your finances is a big feat, especially if you’re just starting out on your own. Personal finance is a central part of your life, and the way you handle money can impact your livelihood. Here are 8 financial mistakes to avoid.

Topics Covered... Not knowing the difference between gross income and net income/take-home pay. Not creating a budget. Not contributing to retirement. Not contributing to an emergency fund. Only making minimum payments on your credit cards. Over-drafting on accounts. Overspending or living beyond your means. Not reading the fine print of a loan. How can CreditU help?

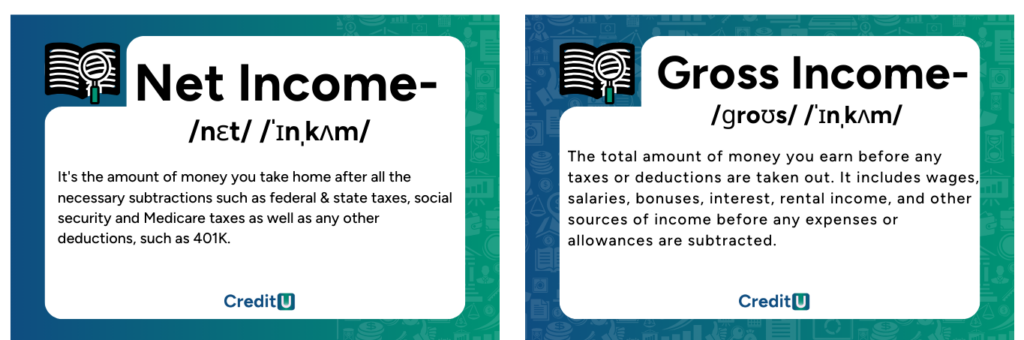

1. Not knowing the difference between gross income and net income/take-home pay.

When you start working, pay close attention to your paycheck. To create an accurate budget for yourself, you must budget according to your net income – aka, your take-home pay.

Gross income refers to the total amount of money that an individual earns before any deductions or taxes are taken out. This includes all sources of income, such as wages, salaries, tips, and bonuses. Net income, on the other hand, is the amount of money that an individual takes home after taxes and other deductions have been taken out. Net income is a person’s income earned after deductions and taxes. In other words, net income is the percentage of take-home pay from each paycheck.

Statutory withholdings on a paycheck include:

- Federal Income Tax

- Social Security Tax

- Medicare Tax

- State and Local Income Tax

Additionally, there are other deductions that impact your net income that may include:

- Health

- Dental

- 401k

- Flexible- Dependent Care

- Flexible-Medical

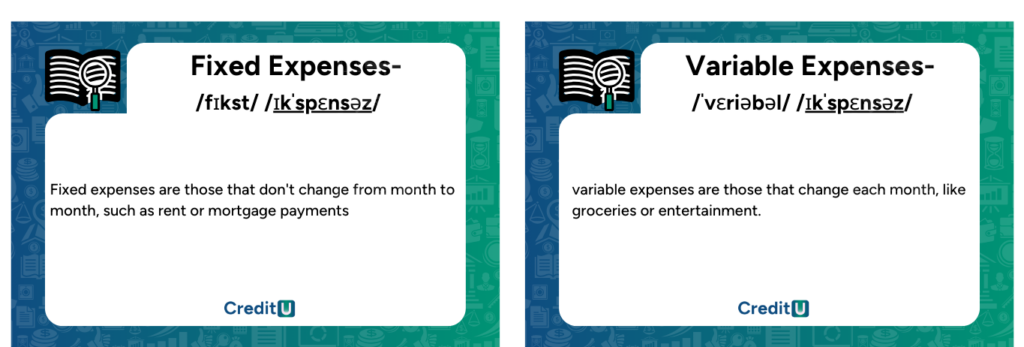

How you adjust your withholdings has a direct impact on your paycheck. Be sure to review the federal and state withholding forms and apply accordingly. The more money that is withheld from your paycheck, the smaller the paycheck. In contrast, the less money that is withheld from your paycheck, the larger the paycheck. Related to our earlier point, you must create an accurate budget. The first step is to figure out how much money you have coming in each month. This includes your salary, any side hustle income, and any other sources of income. Make a list of all your monthly expenses, including rent/mortgage, utilities, groceries, transportation, entertainment, and any other regular expenses you have. Next, categorize your expenses into fixed expenses (like rent/mortgage and utilities) and variable expenses (like groceries and entertainment).

2. Not creating a budget.

Having a budget is important for everyone, regardless of their income or financial situation. A budget helps you keep track of your income and expenses, and ensures that you are living within your means. Overspending is very easy without a proper budget. A budget also helps you identify areas where you can cut back on expenses and save more money. To create a budget, start by listing all your sources of income, including your salary, any side hustles, and any other sources of income (like freelancing) you may have. Then, list all your expenses, including rent/mortgage, utilities, groceries, transportation, and any other expenses you have.

Next, categorize your expenses into fixed and variable expenses. Fixed expenses are those that do not change from month to month, such as rent/mortgage and car payments. Variable expenses are those that can change from month to month, such as groceries and entertainment.

Once you have categorized your expenses, compare your total expenses to your total income. If your expenses are higher than your income, you will need to find ways to cut back on your expenses or increase your income. If your income is higher than your expenses, you can allocate the extra money towards savings or paying off debt.

Remember to review your budget regularly and make adjustments as necessary. A budget is a living document that should change as your financial situation changes. With a little effort, you can create a budget that works for you and helps you achieve your financial goals.

3. Not contributing to retirement.

It’s never too early to save for retirement, and the time to be proactive is now. Even if you can only put away a little each month, that’s better than nothing. Plus, you can take advantage of compound interest. This is when your interest earns interest! Because retirement seems so far away, it’s easy to put saving and investing for it on the back-burner. But when you’re older, playing catchup can be stressful. Take advantage of every retirement option you have, such as an employer-sponsored 401k, or opening an IRA or Roth IRA account.

Many employers offer retirement plans as part of their employee benefits package. These plans are designed to help employees save for their retirement by contributing a portion of their salary to a retirement account. There are several types of retirement plans available through your job, including 401(k)s, 403(b)s, and pension plans. The most common type of retirement plan is a 401(k), allowing employees to contribute a percentage of their salary, and employers may also match a portion of the contributions. 403(b) plans are similar to 401(k)s, but they are available to employees of non-profit organizations, schools, and other tax-exempt organizations. Pension plans are another type of retirement plan that provides a fixed monthly income to employees upon retirement.

Starting to save for retirement is one of the most important financial decisions you can make. The earlier you start, the better off you will be in the long run. So, when should you start saving for retirement? The short answer is: as soon as possible. The reason for this is that saving for retirement takes time. The earlier you start, the more time your savings have to grow. This is important because the power of compounding interest can have a significant impact on the amount of money you will have in retirement. By starting early, you can take advantage of this power and potentially accumulate a larger nest egg by the time you retire.

Generally, financial experts recommend that you start saving for retirement as soon as you start earning an income. This means as soon as you land your first job, you should start contributing to a retirement account. If you’re not sure how to get started, consider talking to a financial advisor who can help you create a retirement savings plan that is tailored to your specific needs and goals. Remember, the earlier you start saving, the more time your money will have to grow, so don’t put it off any longer than necessary.

Determining how much you should save for retirement depends on several factors, including your current age, desired retirement age, expected lifestyle expenses, and any other sources of retirement income. A general rule of thumb is to save at least 10-15% of your income for retirement.

4. Not contributing to an emergency fund.

Again, putting away a little each month is better than nothing. Put this money in an easily accessible place, like a savings account. An emergency fund serves as a buffer against financial pitfalls like job loss, car repairs, or an ER visit. You can use this fund instead of relying on credit cards – which can lead to debt that’s difficult to pay off. Here’s some basic tips on starting an emergency fund:

1. Determine your monthly expenses: Calculate how much money you need to cover your basic living expenses each month, including rent/mortgage, utilities, food, transportation, insurance, and other bills.

2. Set a savings goal: Aim to save at least three to six months’ worth of living expenses. This will give you a buffer in case of a job loss, medical emergency, or other unexpected expenses.

3. Start small: If you don’t have much extra money to save, start with a small amount and gradually increase your contributions over time. Even saving $20 or $50 a month can add up over time.

4. You may want to consider selling items you no longer use or getting a side job to help you grow your emergency fund.

5. Automate your savings: Set up automatic transfers from your checking account to your emergency fund savings account. This will help you save consistently without having to think about it.

6. Keep your emergency fund separate: Keep your emergency fund in a separate savings account from your regular checking and savings accounts. This will help you avoid dipping into it for non-emergencies.

By following these basic tips, you can start building an emergency fund to protect yourself and your finances from unexpected events.

5. Only making minimum payments on your credit cards.

When you’re in debt or if money is tight, it can be tempting to only pay the minimum. But this can result in you paying much more over the long term. The interest rates that the credit card company charges will also keep growing. If you can pay your bill in full, then you should! Or if you need help paying off debt, check out CreditU!

6. Over-drafting on accounts.

When you’re in debt or if money is tight, it can be tempting to only pay the minimum. But this can result in you paying much more over the long term. The interest rates that the credit card company charges will also keep growing. If you can pay your bill in full, then you should!

7. Overspending or living beyond your means.

Oftentimes, excessive spending comes from simple carelessness. Overspending can even present itself in relatively small expenses. As cliched as it sounds, going out to dinner or grabbing a latté every morning really does add up. It’s so easy to swipe your credit card without much thought – but just because a card gives you a lot of credit, doesn’t mean you should use it all! Remember, that money always must be paid back. Plus, if your credit usage ratio gets too high, that can make lenders wary if you apply for credit or a loan in the future.

8. Not reading the fine print of a loan.

Sometimes we do have to take on debt, whether it’s car payments or a mortgage if you choose to buy instead of rent. But make sure you understand all the costs involved. If the loan ends up taking up more of your income than you initially thought, it can cause you to neglect other areas of your finances, such as contributing to retirement or other goals.

As you can see, there are a lot of financial mistakes to avoid. But the longer you go at managing your money, the more confident you’ll be!

How can CreditU help?

With the CreditU app, dodging these financial mistakes will be a breeze! Our user-friendly onboarding will not only walk you through the different types of incomes, but it will also help you understand what they are ( if you need it, you can also just skip ahead). Create a detailed budget inside CreditU and know where you stand financially no matter where you go.

Set saving for retirement and an emergency fund as your financial goals and be able to track them! Link your bank and credit card accounts so that you have all of your balances in one place. It’s harder to overspend when you know you’re balances and have a budget. Download CreditU today and get primary access to financial freedom.

Key Insights – Financial Mistakes To Avoid

1. Stick with the basics of money management such as creating a budget, paying your credit card debt on time always to avoid debt pitfalls.

2. Creating an emergency fund should be a priority. Ensure you are continuing to build this no matter what.

3. Make retirement saving and investments a priority in your finances.

4. Pay attention to detail when it comes to applying for loans or credit cards. Be cautious about the interest rates or other hidden fees to avoid any detrimental financial mistakes. .

Back To Top

Last Updated on January 11, 2024 by Dilini Dias Dahanayake