Banks vs Credit Unions

October 12, 2023

Both Banks and Credit Unions offer numerous financial services but are fundamentally different when it comes to their operations, benefits, and fees. While banks are still a popular option, credit unions have been gaining more recognition in recent times. So what are the factors that differentiate the two? How would they impact your choice to use a bank vs a credit union? It’s important to be educated on the characteristics of both of these institutions to determine the right fit for you. Let’s review them together to understand what they are and what are the key differences between banks vs credit unions.

Topics Covered Banks Credit Unions Banks vs Credit Unions - Key Differences What Can CreditU Do For You? Key insights - Banks vs Credit Unions

Banks

Banks offer people choices to save, borrow, or even accumulate money. You can also get credit cards with them. A bank is a for-profit that invests your money while it’s kept in your accounts.

Banks often have a broader range of services and products compared to credit unions. This includes a diverse array of loan types, investment products, and even insurance in some cases.

Your money is protected (up to $250,000) with FDIC-insured banks. Beyond checking and savings accounts, banks offer other products such as business and mortgage loans. Major banks come with a lot of convenience as well – it’s usually easy to find one of their branches or ATMs near you. One thing to keep in mind is that banks typically charge fees to customers. Their primary objective is to generate profits for shareholders, which can influence their fee structures. You also must maintain a minimum balance in your checking account daily.

Banks often have a broader range of services and products compared to credit unions. This includes a diverse array of loan types, investment products, and even insurance in some cases. Due to their for-profit nature, banks typically have more branches, ATMs, and a significant online presence. This can make them more accessible to a wider audience.

Credit Unions?

A credit union also offers checking and savings accounts. Unlike a bank, a credit union’s goal isn’t to turn a profit. Credit unions function with the customer in mind, and usually provide lower fees and higher saving rates. Most credit unions are insured by the National Credit Union Administration up to $250,000 of your funds is protected at most state-chartered and all federal credit unions.

Though a credit union often has many of the same services as a bank does, such as online banking options, credit cards, and consumer loans, it’s important to note if the credit union meets all your needs. For instance, some credit unions’ online banking sites don’t include features like peer-to-peer payment platforms, and if a credit union doesn’t have any branches near you, it may not be the most convenient way to manage your money.

Credit unions are member-owned, not-for-profit financial cooperatives. When you deposit money into a credit union, you’re essentially buying a share and becoming a part-owner. Credit unions typically serve specific groups or communities. While their physical presence might be limited compared to large banks, many join cooperative networks to increase their ATM access.

Due to their not-for-profit nature, credit unions often offer lower fees and higher interest rates on savings products. Any profits are returned to members in the form of reduced fees, better rates, or other benefits.

What Are The Key Differences – Banks Vs Credit Unions

When it comes to managing your finances, choosing the right institution is crucial. Two of the most common choices are banks and credit unions. While they offer many of the same services, there are distinct differences between the two. Let’s dive into the main distinctions banks vs credit unions apart.

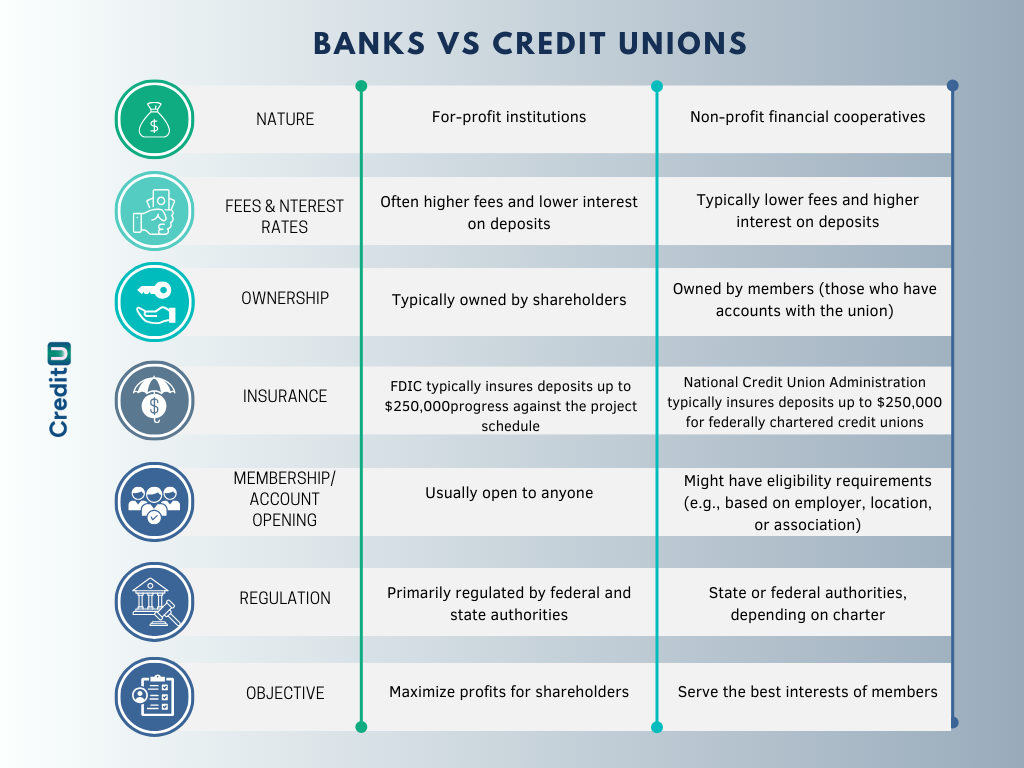

1. Nature of the Institution

Banks: These are for-profit institutions, operating with the primary goal of maximizing profits for their shareholders.

Credit Unions: These are non-profit financial cooperatives. Their main goal isn’t profit, but instead, they aim to serve their members’ best interests.

2. Ownership Structure

Banks: Owned by shareholders, banks’ decisions are often influenced by the aim to generate returns for these shareholders.

Credit Unions: Owned by their members. Every member has a say in the operations, usually through voting on decisions or board members.

3. Objective & Focus

Banks: With a profit-driven objective, banks often have to balance shareholder returns with customer needs.

Credit Unions: Their primary objective is to benefit their members, leading to policies and services that directly cater to member needs.

4. Regulation

Banks: Primarily regulated by federal and state authorities, ensuring their operations adhere to strict financial standards.

Credit Unions: Regulated by either state or federal authorities, depending on their charter. They also follow strict financial standards but might have different requirements compared to banks.

5. Fees and Interest Rates

Banks: Due to their profit-driven motive, they often have higher fees and offer lower interest on deposits.

Credit Unions: Generally, offer lower fees and provide higher interest on deposits, thanks to their non-profit nature and member-focused operation.

6. Membership Requirements

Banks: Typically, open to anyone. Just walk in, and you can open an account.

Credit Unions: Often have specific eligibility requirements. This could be based on where you live, work, or even associations you belong to.

7. Customer Service Approach

Banks: Service can vary, especially in larger banks where the approach might feel more business-like and less personal.

Credit Unions: Renowned for their community-oriented approach. Members often experience a more personal touch in their interactions.

Banks vs Credit Unions – Bottom Line…

Both banks and credit unions have their own set of advantages. Your choice between them should depend on what you value more. Regardless of your preference, always do your research to find the institution that aligns best with your financial needs and values.

What Can CreditU Do For You?

Whether you decide to go with a bank or a credit union, CreditU is a reliable and secure financial management tool that can work for you. With CreditU, you can easily create an account and start organizing your finances within minutes.

One of the most significant benefits of using CreditU is its ability to help you see an overview of your finances. By adding your bank accounts, credit card accounts, debts, and additional sources of income, you can easily track your expenses and identify areas where you could save money. CreditU’s intuitive interface makes it easy to navigate and get a clear understanding of your financial situation.

But that’s not all. CreditU also offers a finance education section with personalized tips tailored to your specific financial situation. Whether you’re looking to save money, pay off debt, or invest, CreditU can help guide you towards making informed financial decisions.

If you’re looking for a reliable, secure, and user-friendly financial management tool, CreditU is an excellent choice. By signing up for an account and utilizing its features, you can take control of your finances and achieve your financial goals.

Key Insights -Banks vs Credit Unions

1. Banks and credit unions both offer several financial products, including savings accounts and certificates of deposit (CDs)

2. The main difference between the two is that banks are typically for-profit institutions while credit unions are not-for-profit and distribute their profits among their members

3. Credit unions can be ideal for a low-interest loan, lower mortgage closing costs or reduced fees. With a qualifying membership

4. Larger banks may offer you more choices regarding products, apps, and services, and anyone can join

5. Choice for a bank or credit union depends on your overall financial goals and your requirement

Last Updated on January 11, 2024 by Dilini Dias Dahanayake