Steps To Make Your Budget – Budgeting 101

April 25, 2023

Managing finances is a skill that everyone needs to master. In today’s modern world, where expenses often seem to crop up out of nowhere, having a solid budget is your first line of defense. A well-planned budget allows you to understand where your money is going, helps you save for future goals, and ensures you’re not spending more than you’re earning. This guide will take you through the steps of creating your first personal budget, breaking down each component to ensure clarity and success.

Topics Covered... The Budgeting Philosophy Steps to Create a Budget Common Budgeting Obstacles and Mistakes What Can CreditU Do For You? Key Insights: Budgeting 101

The Budgeting Philosophy

At its core, budgeting is a process of tracking and planning how to spend your money. It involves creating a plan that outlines your expected income and expenditures for a given period, typically a month. Think of it as a financial roadmap, helping you allocate your resources to different expenses while ensuring you have enough to meet essential needs and save for future goals.

Budgeting is not just about frugality or cutting costs; it’s about making informed decisions that align with your financial goals and values.

The Philosophy Behind Budgeting

Budgeting is more than just numbers on a spreadsheet. It’s a reflection of your values, priorities, and life goals. Here’s what lies at the heart of budgeting:

- Awareness: Budgeting brings awareness to your spending habits. It’s easy to make impromptu purchases or indulge occasionally. But with a budget, you’ll know exactly how these decisions affect your financial health.

- Empowerment: With a clear understanding of your financial situation, you’re able to take control. Instead of feeling overwhelmed by bills or unexpected expenses, you’ll be equipped to handle them. You’ll know when you can splurge and when you need to save.

- Goal Setting: Financial goals could range from short-term objectives like buying a new gadget or going on a vacation to long-term aspirations like purchasing a home or retiring comfortably. A budget is your tool to ensure you’re consistently moving towards these goals and allocating resources effectively.

- Flexibility: Contrary to popular belief, a budget isn’t restrictive. It’s adaptive. Life is unpredictable. A car might break down; you might get a surprise bonus. Budgeting equips you to navigate these changes, adjusting allocations to accommodate life’s ebb and flow.

- Informed Decision Making: With a budget, every financial decision, big or small, is an informed one. Whether you’re contemplating a job change, a significant purchase, or an investment, your budget provides the clarity to decide with confidence.

There are many ways you can maintain a budget — with a spreadsheet, paper, and pen, or through a money management app such as CreditU.

In our Budgeting 101 guide, we’ll go over some budgeting basics, show you how to create a budget, teach you how to avoid common budget-related mishaps, and ultimately, give you a budget calculator and some budgeting tips to create a budget that’s efficient and functional for your lifestyle.

Need to know how to create a budget ASAP? Read end-to-end for a comprehensive guide on Budgeting 101.

This comprehensive guide to Budgeting will go over budgeting basics, show you the steps to creating a budget and how to steer clear of common mistakes in the budgeting process. Having an effective budget will lead to a more effective and functional lifestyle. Get on Board! This is Budgeting 101.

How to Create a Budget – Steps to Make Your Budget

A budget acts as this crucial financial compass, ensuring that you make the most of your earnings, avoid financial pitfalls, and steer towards your goals. If you’re feeling a bit lost about where to start or how to set things in motion, fret not! In this article, we’ll walk you through a step-by-step guide to creating a budget, turning the seemingly daunting task into a manageable and empowering journey.

1. Defining Your Financial Goals

Understanding and defining your financial goals is the foundational step in the budgeting process. Setting clear, concise goals gives you a purpose for your budget and a clear direction for your financial choices. Here’s how to delve deeper into this crucial step:

Short-Term vs Long-Term Financial Goals

Financial goals can generally be classified into short-term and long-term categories. Understanding the distinction between these two and how to approach each effectively can provide clarity to your budgeting process. Let’s dive deeper into both:

Short-Term Goals

Short-term financial goals are targets you aim to reach within a relatively brief period, usually within one year or less. Addressing these can provide immediate benefits or lay the groundwork for longer-term objectives.

Examples of Short-term Goals

- Emergency Fund: Saving up for a fund that covers 3-6 months of living expenses in case of unforeseen events like job loss or medical emergencies.

- Vacation Savings: Setting aside money for a planned holiday or short trip.

- Paying Off Small Debts: Addressing smaller loans or credit card balances.

- Home Repairs: Saving up for anticipated minor home renovations or repairs.

- Special Occasions: Budgeting for events like birthdays, anniversaries, or festivals.

Approaching Short-term Goals

- Immediate Action: Given the shorter timeframe, these goals often require swift actions and regular monitoring.

- Flexible Budgeting: Short-term goals might necessitate a more adaptable budget, allowing for adjustments as needs and circumstances change.

- Visible Tracking: Using tools or apps that provide visual representation can be motivating, as you see yourself making progress.

Long- Term Goals

Long-term goals are financial objectives set for an extended period, usually beyond a year. Achieving these often requires consistent effort, discipline, and a more comprehensive financial strategy.

Examples of Long-Term Goals:

- Retirement Planning: Allocating funds to secure a comfortable lifestyle post-retirement.

- Home Ownership: Saving for a down payment to buy a house or aiming to pay off a mortgage.

- Children’s Education: Creating a fund to cover higher education expenses for your children.

- Major Trips or Vacations: Planning a world tour or an extended vacation.

- Investment Goals: Building an investment portfolio to achieve financial growth over years or decades.

Approaching Long-Term Goals:

- Consistent Savings: Regular contributions, even if they’re small, can accumulate over time due to compound interest.

- Risk Assessment: Understand your risk tolerance, especially if your long-term goals involve investments.

- Regular Reviews: The long timeframe means external factors (like economic conditions) can change, so it’s essential to periodically review and adjust your strategies.

- Seek Expertise: Given the complexities of some long-term goals, consulting with financial advisors or experts can provide valuable insights.

SMART Goals Approach:

Ensure your financial goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying “I want to save money for a car,” a SMART goal would be “I want to save $10,000 for a new car by December 2023.”

Prioritize Your Goals:

Not all financial goals carry the same weight. Determine which ones are most important to you. For example, while taking a luxury vacation might be desirable, saving for an emergency fund might need to take precedence.

Consider Future Needs and Wants:

Think about life events or milestones you anticipate in the future. Are you planning to get married, have children, or switch careers? Predicting these can help you plan and prioritize your financial goals better.

Regularly Review and Adjust:

Your financial aspirations may evolve over time due to changes in personal circumstances, financial situations, or aspirations. Regularly revisiting your goals ensures they remain aligned with your current situation and desires.

Seek Guidance:

If you’re unsure about setting or prioritizing your financial goals, consider seeking advice from financial advisors or trusted individuals who’ve successfully managed their finances. They can offer invaluable insights and guidance.

Remember, your financial goals should be a reflection of what you value and where you see yourself in the future. They give your budget a sense of purpose, ensuring that every financial decision you make is a step towards achieving what’s most important to you.

2. Calculate Your Income

Let’s start with the basics: How much money are you making? In this first step, we’ll help you figure out your total earnings. We’ll count everything, from your main job to any extra cash you get on the side. Knowing this is key to building a good budget. So, let’s dive in and see what you’re working with! The money you have left for your household expenses is called the income after taxes and other deductions.

If you are a salaried Employee:

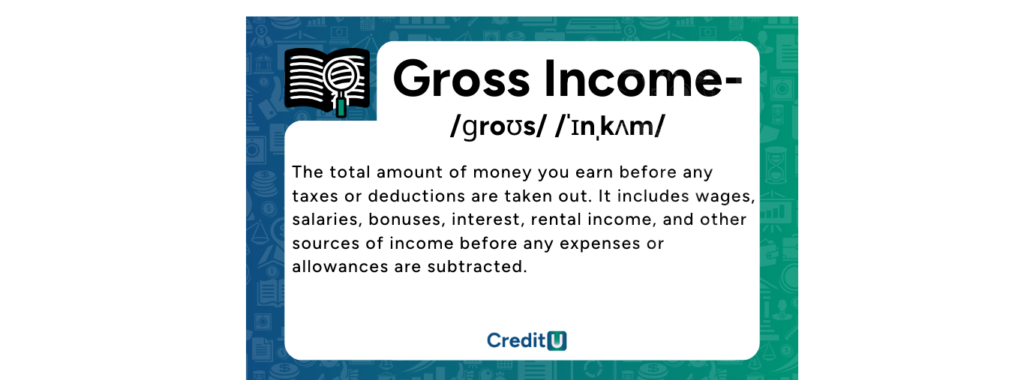

You already know what your annual salary is. This is your gross income:

To calculate your monthly gross income, you can simply divide your annual salary by 12.

Formula Annual Salary /12 = Monthly Salary

Example Let’s say you earn $60,000 as your annual salary. Therefore, your monthly salary would be:

$60,000 (Annual Salary) /12 (Number of Months) = $5,000

In this example, your monthly salary would be $5,000 before taxes and any other deductions.

If you are on hourly wages:

To determine your monthly salary based on an hourly wage, you’ll need to multiply your hourly rate by the number of hours you work each week, and then multiply that by the number of weeks you work each month.

Formula: Hourly Wage × Hours Worked Per Week × Weeks in a Month = Monthly Salary

Example: Let’s say you earn $15 per hour and work 40 hours a week. If we assume an average of 4 weeks per month: $15 (hourly wage) × 40 (hours per week) × 4 (weeks per month) = $2,400

In this example, your monthly salary would be $2,400 before taxes and any other deductions.

What is Your Take-Home Pay (Net Income)?

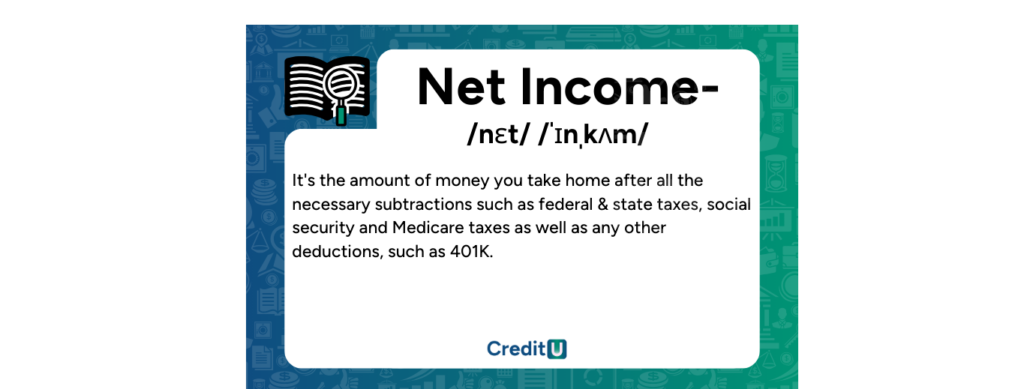

Now that you know the gross income it is time to calculate your net Income also known as monthly take- home pay.

So, you’ve received your paycheck, and you’re wondering where all your hard-earned money went? Let’s break it down in simple terms and focus primarily on those deductions that nibble away at your gross income.

Deductions: Here’s where slices of your pie start to get served out:

Federal and State Taxes: The government takes its share. This amount is determined by your earnings, your tax filing status (single, married, etc.) etc. A predefined percentage of your income will go towards these categories of taxes. This is often calculated based on your annual salary. You can divide this number by 12 to get a monthly tax deduction. Your liability to state differs depending on where you are located. Read More

Social Security and Medicare (FICA): These are mandatory deductions that go toward your future benefits when you retire or if you need specific social assistance. According to the IRS, the federal withholding rates for FICA are:

– 6.2% for Social Security

– 1.45% for Medicare

Health Insurance: If your employer provides health benefits, and you’ve opted in, your contribution to the insurance premium gets deducted here.

Retirement Contributions: If you’ve chosen to put money into a company-sponsored retirement plan, like a 401(k), that amount is taken out before you see your paycheck.

Other Deductions: These could include things like union dues, life insurance, or wage garnishments (money taken out to pay a debt).

After gathering all the details on your deductions and taxes, you can calculate your total monthly deductions. This figure represents the sum of all amounts taken out of your paycheck each month.

Net Income (or Take-Home Pay): After all these deductions, what’s left is yours to spend, save, or invest. It’s the piece of pie you get to enjoy.

In a nutshell, while your paycheck starts as a full pie (gross income), various slices are taken out (deductions) for different reasons, leaving you with the final piece (net income) to relish. Knowing where each slice goes can help you better understand your earnings and plan your finances.

3. Calculate Your Expenses for the Budget

Understanding and managing your expenses is at the heart of effective budgeting. To build a clear and efficient budget, you need to know not just how much money is coming in, but also where it’s going out. Let’s dive deeper into calculating your expenses and understanding the nuances of each type:

Gather Your Statements:

Begin by rounding up all your financial documents from the past month. This includes bank statements, credit card bills, digital transaction records, paper receipts, and even that coffee you paid for in cash. By compiling everything, you ensure no expense slips through the cracks.

Example: If you use mobile banking, check your transaction history for the past month. If you had a few cash transactions, try to keep a notebook or a digital note where you jot down those expenses. Every dollar counts!

Categorize Your Expenses:

Expenses are generally divided into two main categories: Fixed and Variable.

Fixed Expenses:

These costs remain consistent each month. Think of them as the non-negotiables; they rarely change and are usually paid on a regular schedule. Create a list of all of the expenses that falls into this category to get an accurate picture of your fixed monthly expenses.

Examples:

Rent or Mortgage: If you pay $1,200 every month for your apartment, that’s a fixed expense.

Car Loan: A monthly payment of $300 toward your car loan remains unchanged until the loan is paid off.

Insurance Premiums: Whether it’s health, car, or home insurance, you usually pay a consistent amount.

Subscription Services: Monthly charges like your Netflix or gym membership count here.

Variable Expenses:

As the name suggests, these costs can vary from one month to another. They’re more flexible and often directly reflect your lifestyle choices. Estimating variable expenses accurately every month is a daunting task. Your budget will improve as you have better estimates. Take into account as many life events as possible to get the most accurate estimate.

Examples:

Groceries: In January, you might spend $400 on groceries, while in February, it might be $350 due to a vacation.

Dining Out: Some months, you might eat out more frequently, leading to higher costs.

Entertainment: Buying a new book, going to a concert, or taking a short weekend trip.

Utilities: Your electricity bill might be higher in the summer due to air conditioning, and lower in the fall.

Gasoline: If you travel more or prices surge, this expense can fluctuate.

Plan for Savings and Investments:

In the realm of personal finance, the emphasis on savings and investments cannot be overstated. While everyday expenses and immediate liabilities often take precedence in our budgeting process, the foresight to allocate funds for savings and investments can dictate your financial stability and growth in the long run.

1. Emergency Fund:

An emergency fund is a safety net designed to cover unexpected expenses. Whether it’s a sudden medical expense, unexpected car repairs, or an unforeseen job loss, having this fund can prevent you from falling into debt.

2. Savings for Future Travels:

Travel can be enriching but also expensive. Setting aside funds specifically for travels can ensure you can take that dream vacation without plunging into financial stress.

3. Big Goals and Life Milestones:

This includes saving for a down payment on a home, your children’s education, a wedding, or any other significant life event you foresee in your future.

4. Investments:

Investments are not just about accumulating wealth but also about growing and preserving the wealth you already have. Whether you’re considering stocks, bonds, mutual funds, or real estate, investments can offer returns that outpace standard savings accounts.

List and Tally:

Now, with your categorized expenses, create a list. Write down each expense under its respective category, making note of the amount spent. Money Management apps such as CreditU can make this process easier for you with its ability to keep your records organized.

Once each category is tallied, sum them all to get your total monthly expenses.

Example: If your fixed expenses come to $1,800 and variable expenses are $600, your total monthly expenses are $2,400.

Having a detailed understanding of your expenses will spotlight areas where you can potentially cut back and save. It also offers clarity, ensuring that you’re living within your means and not spending more than you bring in. This knowledge forms the foundation of effective budgeting, setting you on the path toward financial health and stability.

4. Implement and Monitor Your Budget:

Taking the time to craft a budget is just the beginning; the real work lies in putting it into practice and regularly checking its effectiveness. This phase, crucial to the success of your financial plan, involves active participation and adjustment as you navigate through your financial journey. Here’s a deeper dive into this crucial step:

Start with Commitment:

Before anything else, commit wholeheartedly to your budget. Understand that a budget isn’t a restriction but a tool that empowers you to have better control over your finances.

Tips:

- Remind yourself of your financial goals regularly.

- Visualize the benefits of sticking to your budget, such as debt freedom or purchasing your dream home.

Use Budgeting Tools:

There are numerous tools available that can help streamline the budgeting process, from traditional pen and paper to sophisticated apps and software.

Tips:

- Explore money management apps like CreditU or even simple Excel spreadsheets.

- Set alerts for bill payments or when nearing the limit of a particular budget category.

Schedule Regular Check-ins:

Consistent monitoring is key. By regularly reviewing your budget, you can ensure you’re staying on track and make necessary adjustments in real-time.

Tips:

- Set aside time weekly or bi-weekly to go over your spending.

- Monthly deep dives can help assess larger trends or issues.

Adjust as Necessary:

Life is unpredictable. Emergencies, changes in income, or unexpected expenses can arise, requiring you to recalibrate your budget.

Tips:

- Stay flexible. If an unexpected expense arises in one category, see where you can cut back in another.

- Review and adjust your budget especially during significant life events such as marriage, having a child, job change, or buying a home.

Track Your Progress:

Celebrating small victories can keep you motivated. As months go by, you’ll see the tangible benefits of your budgeting efforts.

Tips:

- Mark milestones, like paying off a particular debt or achieving a savings goal.

- Reflect on the progress and challenges every few months to keep the momentum.

In essence, implementing and monitoring your budget is a dynamic and ongoing process. It requires diligence, adaptability, and a keen understanding of your financial patterns. Remember, a budget is a living document, and refining it over time will only enhance its effectiveness and relevance to your life.

Steps to Make Your Budget: Common Budgeting Obstacles and Mistakes:

Embarking on the journey of budgeting is commendable, but it’s not always smooth sailing. Many individuals face hurdles, some of which are self-imposed due to misconceptions or lack of awareness. Here’s a quick look at common budgeting obstacles and mistakes to watch out for:

Overcomplicating the Process:

While there are various methods and tools for budgeting, not all of them will be suitable for everyone. Sometimes, a simple spreadsheet or pen and paper method might be all you need. Overcomplicating your budget can make it harder to stick to.

Life is dynamic, and so should your budget be. Failing to update your budget after significant life events (e.g., birth of a child, job change) can derail your financial goals.

Being Too Rigid:

While discipline is essential, being too strict can backfire. It’s crucial to allow some flexibility in your budget for unexpected expenses or occasional treats.

Not Reviewing and Adjusting Regularly:

A budget isn’t a “set and forget” tool. It needs regular reviews and adjustments to remain effective and aligned with your goals.

Failing to Account for All Income:

Relying solely on your main paycheck without considering other income streams, like bonuses or side gigs, can distort your financial picture.

Underestimating Expenses:

Whether it’s not accounting for that daily coffee or occasional dinners out, underestimating or omitting expenses can disrupt your budget.

Not Having an Emergency Fund:

Unforeseen emergencies can strike at any time. Without an emergency fund in place, you might be tempted to derail your budget or fall into debt.

Setting Unrealistic Goals:

While ambition is commendable, setting unrealistic financial goals can lead to frustration. It’s essential to make sure your goals are achievable, given your income and expenses.

Not Celebrating Small Wins:

Only focusing on long-term goals and ignoring small milestones can demotivate you. Celebrating small victories can keep you encouraged and on track.

In conclusion, while these obstacles and mistakes are common, being aware of them is half the battle. By recognizing these pitfalls early on, you can take proactive measures to avoid them, ensuring a smoother budgeting journey.

What Can CreditU Do For You?

CreditU is an all-in-one personal finance app that streamlines the management of your finances. With its comprehensive features, you can easily track your income and expenses, create budgets, and gain access to personalized financial education.

Whether you want to set financial goals or gain insights into your spending habits, CreditU has got you covered. By using this app, you can save time and effort in managing your finances, which can lead to greater financial stability and security.

One of the unique features of CreditU is its ability to help you monitor your credit score. With updates on your credit status, you can stay on top of your credit health and make informed decisions when it comes to borrowing or applying for loans.

Additionally, CreditU provides you with a secure platform to manage your debts. With its user-friendly interface and intuitive design, CreditU makes it easy for anyone to manage their finances effectively. So whether you’re a seasoned budgeting pro or just about to create your first one, CreditU is the perfect tool to help you budget effectively and achieve your financial goals. Click here for more information. Don’t forget to Download CreditU today!

Budgeting 101 – Key Insights

1. Budgeting can be broken down into these fundamental steps to ensure financial success:

2. Determining your net income

3. Gauging your monthly outgoings

4. Designating targets for savings and clearing debts

5. Documenting your financial activities

6. Evaluating your financial journey regularly for the most suitable budgeting approach and resources, research various methods, seek recommendations, and experiment with diverse tools. Stay on top of budgeting by anticipating unforeseen expenses and refining your budget plan as situations evolve.

Last Updated on February 29, 2024 by Dilini Dias Dahanayake