Becoming Debt-Free and Financially Independent

April 25, 2023

Envision a life where you can take a deep breath without the burden of debt and the constant stress of making monthly payments. A life that allows you to live on your own terms. The journey to becoming debt-free is a life-changing experience that will improve your overall well-being. In this post, we will delve into practical techniques and offer the necessary resources to help you break free from the chains of debt once and for all. Let’s start this journey together and pave the way towards a brighter future, free from the constraints of debt!

Topics Covered... Create a budget and prioritize expenses. Build an emergency fund. Monitor your progress and stay accountable. Implement a debt repayment strategy. Pay more than the minimum payment. Budgeting and tracking expenses with CreditU.

1. Create a Budget and Prioritize Expenses.

Creating a budget is an essential part of financial planning. It helps to manage your money effectively and achieve your financial goals. The first step in creating a budget is to determine your income and expenses. This includes tracking your income sources, such as your salary or other sources of income, and your expenses, including bills, groceries, and other expenses.

Once you have identified your income and expenses, it is important to prioritize your expenses. Start by focusing on the essential expenses such as rent, utilities, and groceries. These are the expenses that you cannot avoid and must be paid each month. Next, prioritize your debt payments, such as credit card payments or loan payments. If you have extra money left over after paying for essential expenses and debt payments, you can allocate funds for other expenses.

To prioritize your expenses effectively, try to create a list of all your expenses and rank them in order of importance. This will help you to allocate your funds more effectively and ensure that you are not overspending in any one area. Remember, the key to financial success is to live within your means and prioritize your expenses based on your financial goals and needs. By creating a budget and prioritizing your expenses, you can take control of your finances you can become debt-free faster and achieve financial stability.

2. Build an Emergency Fund.

Building an emergency fund is a crucial step towards achieving financial stability and independence. Emergency funds act as a safety net, protecting you from unexpected financial situations that can arise at any time. Without an emergency fund, you may find yourself relying on credit cards or loans to cover unexpected expenses, which can threaten your ability to become debt-free.

To start building your emergency fund, it’s recommended that you aim to save at least 3-6 months’ worth of living expenses. This amount may vary depending on your personal circumstances, such as job security and monthly expenses. It’s important to keep your emergency fund in a separate, easily accessible account, such as a high-yield savings account or a money market account.

When you have an emergency fund, you can rest assured that unexpected expenses will not cause financial strain or derail your financial goals. In fact, having an emergency fund is a key component of any successful budget. It allows you to be prepared for the unexpected, and it gives you peace of mind knowing that you’re covered in case of an emergency. So, start building your emergency fund today, and take the first step towards achieving financial security and stability.

3. Monitor Your Progress and Stay Accountable.

Now it’s not enough to just create a budget; you also need to monitor your progress regularly. This will help you to identify areas where you may be overspending and make necessary adjustments to your plan.

Tracking your spending is also essential to staying on top of your finances. It’s easy to lose track of your expenses when you’re not keeping an eye on them, and this can lead to overspending. By tracking your expenses, you’ll have a better understanding of where your money is going and where you can cut back.

Another important aspect of managing your finances is monitoring your debt balances. If you have outstanding debts, it’s essential to make regular payments and track your progress. This will help you to stay on track with your payments and avoid falling behind on your debts.

As you make progress towards your financial goals, it’s important to celebrate your milestones. This will help you to stay motivated and continue working towards becoming debt-free. Additionally, you can seek support from friends, family, or online communities to stay accountable and motivated throughout your journey.

4. Implement a Debt Repayment Strategy.

When it comes to implementing a debt repayment strategy, it’s important to first assess your current financial situation. Take some time to gather all your debt information, such as the amount owed, interest rates, and minimum monthly payments. Once you have a clear picture of your debt, you can start exploring different repayment strategies.

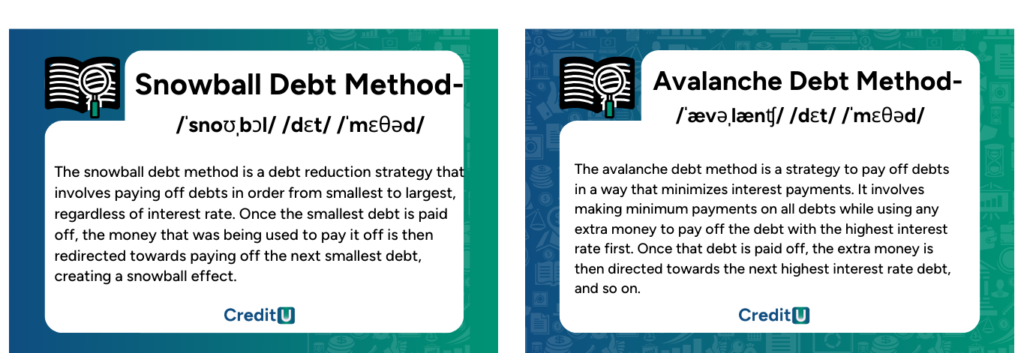

One popular strategy is the debt snowball method, which involves paying off debts from smallest to largest. This approach can be motivating because you’re able to see progress quickly as you pay off each debt. Another strategy is the debt avalanche method, which prioritizes debts with the highest interest rates. This approach can save you money in the long run by reducing the amount of interest you pay.

It’s important to choose a strategy that aligns with your financial goals and motivates you to stay on track. In addition to selecting a strategy, consider using cash instead of credit cards whenever possible. This can help you stick to your budget and avoid racking up more debt. An effective way to do this is by using the envelope method, where you allocate a certain amount of cash for each category of your budget and only spend what’s in the envelope.

5. Pay More Than The Minimum Payment.

Paying the minimum payment required each month might seem like an easy option. However, this approach can end up costing you more in the long run. By only paying the minimum payment, you’re essentially stretching out the repayment period and allowing interest to accrue over time. This can lead to a larger overall payment amount and a longer time spent in debt.

To avoid this situation, it’s important to pay more than the minimum payment whenever possible. By doing so, you’ll be able to reduce your debt faster and save money on interest charges. One way to determine how much extra you should pay is to use an online calculator. These tools can help you determine the amount of money you need to pay each month to pay off your debt in a reasonable time frame.

In addition to saving money, paying more than the minimum payment can also help improve your credit score. By paying off your debts faster, you’ll be able to become debt-free quicker, reduce your credit utilization rate, and show lenders that you’re a responsible borrower.

How Can CreditU Help?

Managing your finances can be a daunting task, but with CreditU, it’s never been easier. The CreditU app allows you to create a personalized budget that suits your needs. Whether you want to save for a vacation or pay off your debts, CreditU helps you achieve your financial goals.

With CreditU, you can easily add and track your expenses. The app provides you with a clear overview of your spending habits, so you can identify areas where you can save money. You can even set up custom categories for your expenses, so you can see exactly where your money is going.

One of the best things about CreditU is that it allows you to monitor your debt from the app. You can input how much debt you have, and the app will help you keep track of it. You can see how much you owe, how much interest you’re paying, and how long it will take you to pay it off. You’ll finally be able to see the finish line for becoming debt-free with CreditU.

But what really sets CreditU apart is its ability to help you create financial goals. You can set a goal to pay off your debt, save for a down payment on a house, or anything else you can think of. The app will help you come up with a plan to achieve your goal, and will provide you with regular updates on your progress.

In short, CreditU is an incredibly powerful financial tool that can help you take control of your finances. Whether you’re trying to save money or pay off debt, CreditU makes it easy. Download CreditU today!

Key Insights – Becoming Debt Free

- Budgeting and Expense Tracking Creating a budget and tracking expenses is critical. It allows you to understand where your money is going and to identify areas where you can cut back. This helps in allocating more funds towards paying off debts.

- Debt Repayment Plan Formulating a debt repayment strategy is vital. The “snowball” (paying off smallest debts first for psychological wins) or “avalanche” (paying off highest interest debts first) methods are popular. Committing to a plan can lead to more disciplined debt reduction.

- Emergency Fund Building an emergency fund is important to avoid new debt. This fund acts as a buffer for unexpected expenses, so you don’t have to rely on credit cards or loans in case of emergencies.

- Income Streams Increasing your income can accelerate debt repayment and savings. This might include getting a higher-paying job, working more hours, starting a side hustle, or investing in income-generating assets.

- Invest and Save Wisely Once debt is under control, it’s important to save and invest wisely to build wealth over time. This includes taking advantage of retirement accounts, understanding the basics of investing, and possibly consulting a financial advisor.

Back To Top

Last Updated on January 11, 2024 by Dilini Dias Dahanayake