How to Read a Credit Report

April 25, 2023

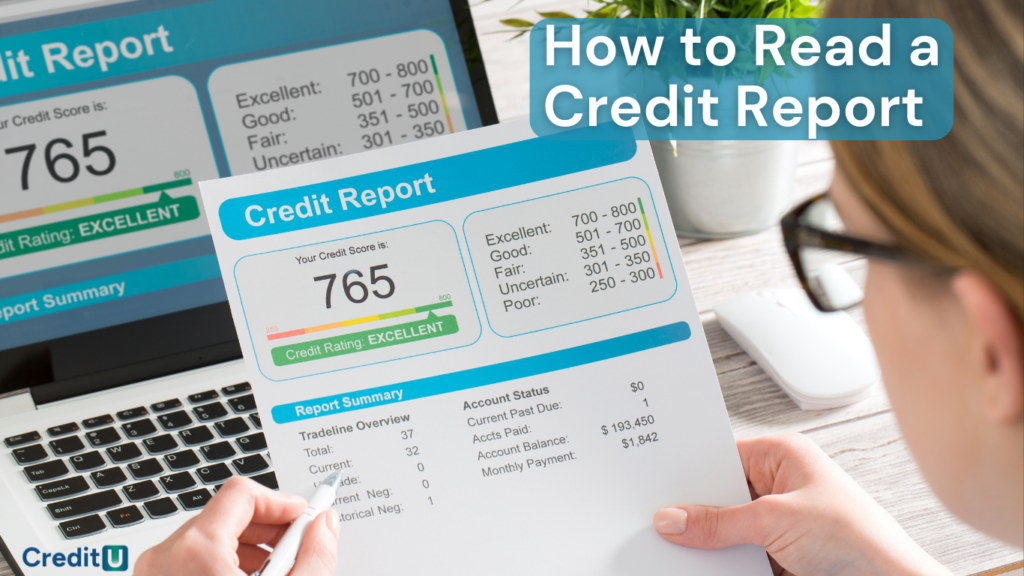

Your credit rating is not just a number; it’s the key to securing favorable terms on loans, credit cards, and navigating other pivotal financial milestones. Maintaining a good credit rating starts with understanding what’s on your credit report. This knowledge allows you to identify potential pitfalls, discrepancies, or areas that may be impacting your score negatively. While many are familiar with the term “FICO score”, another notable rating to be aware of is the VantageScore. Both derive from the information on your credit report, which encompasses personal data, credit accounts, collection items, public records, and inquiries. With the FICO score, factors such as payment history, credit utilization, amounts owed, length of credit history, credit mix, and new credit determine your rating. A credit report is an important tool that lenders use to evaluate your creditworthiness when you apply for credit. Let’s go over how to read a credit report:

Topics Covered... How to Read Your Consumer Credit Report Personal Information Credit Accounts Collection items Public Records Inquiries Where to Get Your Credit Report Understand Your Credit Score Steps to Improve Your Credit What Can CreditU Do For You? Key Insights; How to Read Your Credit Report

How to Read Your Credit Report

Navigating your consumer credit report might seem daunting at first, but with a little guidance, it becomes much more straightforward. This section will walk you through the essential components of a consumer credit report, helping you understand its structure and the significance of each section. Let’s demystify the process and empower you to make informed financial decisions.

Personal Information:

This section includes your name, address, Social Security number, and date of birth. In this first section you should review your personal information. Ensure your name, address, and other personal details are correct. If you find any errors, you should contact the credit bureau to have them corrected. Here is a brief explanation of the items included in this section of the credit report.

Name and Aliases: Your full legal name, as well as any other names you may have used (like maiden names or nicknames).

Current and Previous Addresses: Where you’ve lived, starting with your current address, followed by previous ones. This helps lenders verify your residency over time.

Social Security Number (SSN): This is usually partially masked for security, but it’s used to match the report to you specifically.

Date of Birth: Ensures that the credit data corresponds to the correct individual, especially if there are others with a similar name.

Employment History: While it might not include every job you’ve ever had, it provides an overview of your work history, which can be a factor some lenders consider.

This section doesn’t influence your credit score directly, but inaccuracies can be a sign of identity theft or errors, which is why it’s crucial to ensure that all the information is correct and up to date.

Credit Accounts

This section includes information about your credit accounts, such as the type of account, the date it was opened, your credit limit or loan amount, your payment history, and your current balance.

This is the most crucial section of your credit report. You should review this section carefully to ensure all the information is accurate. Pay close attention to your payment history. Late payments, collections, and charge-offs can hurt your credit score. If you find any errors, you should dispute them with the credit bureau. Here’s a brief description what you can expect to find under this section:

Account Type: This indicates the kind of account, such as credit card, mortgage, auto loan, student loan, or other types of credit.

Account Status: This will show if the account is open, closed, in default, or paid off.

Date Opened: The date when the account was first established.

Credit Limit or Loan Amount: For credit cards, this would be your credit limit. For loans, it’s the original loan amount.

Balance: The current amount you owe.

Payment History: A record of your payments, showing if they were made on time, late, or missed altogether.

Regularly reviewing this section ensures that all listed accounts are accurate and belong to you. Discrepancies can indicate mistakes or potential fraud, so it’s crucial to keep an eye on this section and report any inconsistencies you find.

Collection Items:

The “Collection Items” section of a credit report highlights any unpaid debts that have been sent to a collection agency by the original creditor. When a debt remains unpaid for an extended period, typically after multiple reminders from the creditor, it may be handed over to a collection agency to recover the owed amount.

Features of this section include:

Name of the Collection Agency: Identifies the agency currently holding the debt.

Original Creditor: Shows the original source of the debt.

Outstanding Amount: Displays the total amount you owe.

Date of Last Activity: Indicates the last time there was any activity on that account, which could be a payment, a missed payment, or another action.

Date Opened: Reveals when the collection account was opened, which might differ from when the original debt began.

It’s essential to review this section carefully. If you find any discrepancies or believe a collection item is listed in error, you should dispute it with the credit bureau. Keeping this section clean is vital because collection items can significantly impact your credit score and stay on your report for seven years.

Public Records

The public records section of a credit report provides information on significant legal matters tied to an individual’s financial history. These records can include:

Bankruptcies: Details about any bankruptcy filings, including the type and date of filing.

Tax Liens: Unpaid tax debts that have been claimed by government entities.

Judgments: Court decisions related to unpaid debts, such as those from lawsuits or small claims court.

Foreclosures: Property taken by a lender due to unpaid mortgage debts.

Having public records on your credit report can significantly impact your creditworthiness. These items typically remain in the report for 7 to 10 years, depending on the nature of the record. It’s essential to review this section for accuracy and to be aware of any potential negative impacts on your credit score.

Inquiries

The “Inquiries” section of your credit report records every time a third party, usually a lender or creditor, checks your credit. There are two main types of inquiries:

Hard Inquiries: These occur when you apply for credit, such as a mortgage, car loan, or credit card. Hard inquiries can temporarily lower your credit score by a few points. Multiple hard inquiries within a short period might signal to lenders that you’re a high-risk borrower.

Soft Inquiries: These are checks that don’t affect your credit score. Examples include when you check your own credit or when a company does a background check for purposes other than lending, such as a potential employment.

It’s essential to review the “Inquiries” section to ensure accuracy. If you find hard inquiries you didn’t authorize, it could be a sign of fraud or identity theft. Regularly monitoring this section can also help you better manage and protect your credit health.

Where to Get Your Credit Report

Getting your hands on your credit report is a straightforward process. In the U.S., there are three major credit reporting agencies: Equifax, Experian, and TransUnion. By law, you’re entitled to one free report from each of these agencies every 12 months. This can be conveniently accessed through the official website, AnnualCreditReport.com. Outside of this, many personal finance websites and apps offer credit report monitoring, though some may come with fees. It’s always essential to ensure you’re using a reputable service to avoid scams and protect your personal information. Remember to review your credit report regularly, ensuring all the information is accurate and up-to-date.

Understand your credit score:

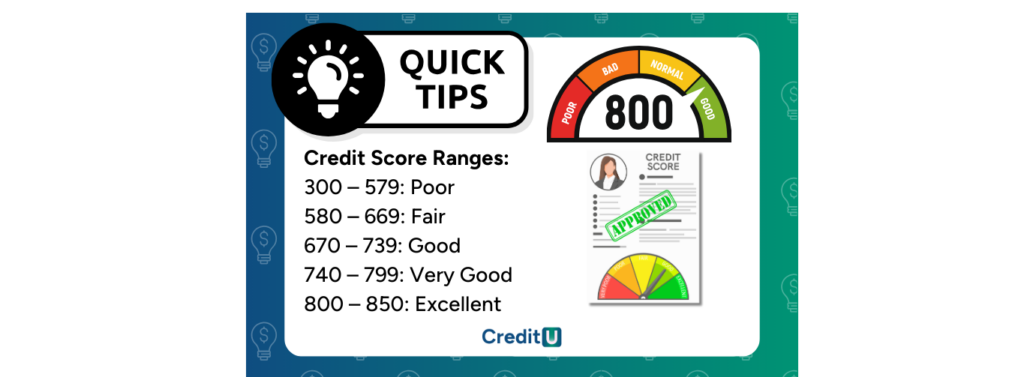

Your credit score is a three-digit number based on your credit report’s information. It’s an important tool that lenders use to evaluate your creditworthiness. The higher your credit score, the better your chances of getting approved for credit and favorable terms.

There are several different credit scoring models, but the most commonly used model is the FICO score. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness.

Steps to Improve Your Credit – Perks of Knowing How to Read a Credit Report

Discovering inaccuracies on your credit report can be alarming, but it’s crucial to address these discrepancies promptly. If you spot any mistakes or unfamiliar accounts, initiate a dispute directly with the credit bureau. Each bureau has a procedure in place for this, ensuring that consumers have the means to rectify false information.

In addition to rectifying errors, there might be times when your credit report reflects legitimate negative information. If that’s the case, it’s time to be proactive in enhancing your credit health. Here’s a roadmap to help elevate your credit score:

Timely Bill Payment: Consistently paying your bills before or by their due dates has a positive impact on your credit score. Missed or late payments can stay on your credit report for years, so punctuality is crucial.

Maintain Low Credit Card Balances: High balances, especially those approaching or exceeding your credit limit, can be detrimental to your credit score. Aim to use only a small portion of your available credit, ideally less than 30%.

Be Prudent When Applying for New Credit: Every time you apply for credit, a ‘hard inquiry’ is made on your report. Multiple hard inquiries in a short time can signal to lenders that you’re a high-risk borrower. Only apply for new credit when genuinely necessary.

Regularly Review Your Credit Report: Frequently monitoring your credit report helps you catch and dispute inaccuracies early on. It also keeps you informed about your credit standing, allowing you to make more educated financial decisions.

By following these guidelines and staying informed, you can maintain a healthier credit profile, paving the way for better financial opportunities in the future.

What Can CreditU Do For You?

Learning how to read a credit report is extremely important on your journey to financial freedom along with routinely monitoring your credit score. With the all-new CreditU app, you can add your bank accounts, credit card accounts, your debt, your income, and expenses so that you can have a well rounded view of your personal finances.

By using the CreditU app, you can easily track your spending habits, identify areas where you can cut back, and set financial goals for yourself. The app provides you with personalized tips and recommendations on how to improve your credit score and reduce your debt.

With CreditU, you can take control of your finances and achieve your financial goals. So what are you waiting for? Sign up for the CreditU app today and start your journey towards financial freedom!

Key Insights – How to Read Your Credit Report

1. Reading a credit report is an essential skill that can help you take control of your finances.

2. By understanding the information in your credit report, you can identify errors, and take steps to improve your credit.

3. Always act proactively towards keeping your credit score aligned with your financial goals.

4. Equip yourself with the knowledge to make informed financial decisions and ensure your credit report accurately reflects your financial behavior.

Last Updated on January 11, 2024 by Dilini Dias Dahanayake