Creating Emergency Funds

August 31, 2023

Life is full of surprises – including the unwelcome ones like medical bills, job loss, or urgent repairs at home. These events can stress us out both emotionally and financially. This is where an emergency fund comes in. Think of it as a safety net for your money. It’s a special savings account that helps cover unexpected costs without adding debt. In this guide, we’ll explain why consumers need emergency funds and provide tips on how to start one.

Emergencies challenge our readiness to handle unexpected problems. Having money set aside especially for these situations means we’re better prepared. Emergency funds aren’t just about saving money. They’re about peace of mind and keeping our financial goals on track, even when life throws us a curveball. It’s a safety buffer that can stop us from going into debt when unexpected expenses come up. So, let’s dive into the importance of emergency funds and how to build one.

Topics Covered... What is an Emergency Fund? Why Do You Need an Emergency Fund? How to Build an Emergency Fund How to Calculate the Right Amount for Your Emergency Fund The Key Characteristics of an Emergency Fund What Can CreditU Do For You? Key Insights - Building an Emergency Fund

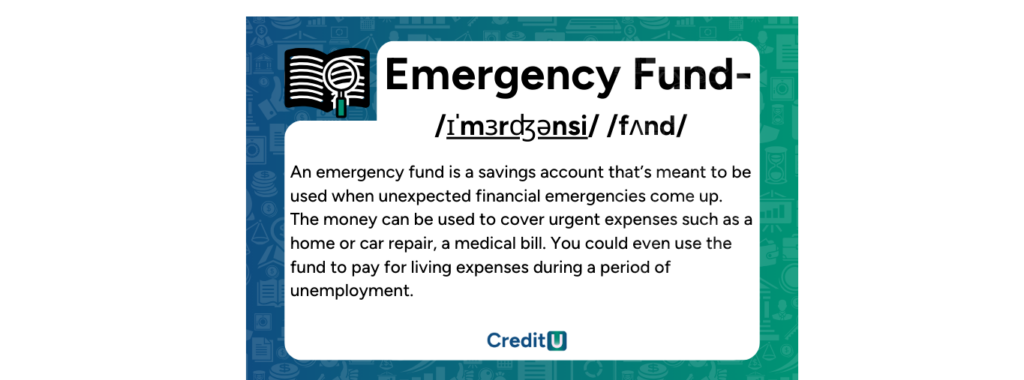

What is an Emergency Fund?

An emergency fund is a savings account that’s meant to cover unexpected and urgent financial needs. It acts as a financial safety net, providing individuals with money they can use in emergencies without relying on credit cards, loans, or other forms of debt. Typically, a fully-funded emergency fund contains enough money to cover several months’ worth of living expenses, ensuring that the individual can weather financial hardships like job loss, medical emergencies, or major unexpected repairs.

Why Do People Need Emergency Funds

-

Financial Security:

Safety Net for Unpredictable Times: Life is full of uncertainties. From medical emergencies to car repairs, unexpected costs can arise at any moment. An emergency fund serves as a shield, ensuring you don’t get caught off-guard during these challenging times.

Avoidance of High-Interest Debt: When faced with sudden expenses, many people resort to credit cards or payday loans, both of which can come with exorbitant interest rates. An emergency fund provides a cushion, allowing you to bypass these costly borrowing methods.

-

Reduces Stress:

Peace of Mind: Money woes rank high among stressors for many individuals. But when consumers have emergency funds in place, they’ll be less stressed knowing that they can pay for whatever comes up.

Preparedness: Emergency funds prepare you for the unexpected, which can reduce any panic or anxiety that unexpected costs often cause.

-

Avoids Debt:

Bypassing Costly Borrowing: Without an emergency stash, the immediate reaction to unexpected expenses might be to pull out a credit card or take out a loan. These methods often lead to spiraling debt due to interest and potential fees.

Ensuring Financial Health: An emergency fund means you’re less likely to miss bill payments or default on obligations, preserving your financial health and credit score.

-

Enhances Independence:

Self-reliance: In times of financial need, it’s comforting to know that you don’t have to rely on family or friends for monetary help. Your emergency fund ensures you can independently handle unexpected costs.

Freedom to Choose: With the backing of an emergency fund, you’re in a position to evaluate options and make the best decisions without being pressed into accepting unfavorable terms or conditions out of desperation.

-

Allows Time for Decision Making:

Avoiding Rash Choices: Financial emergencies can force individuals into making hasty decisions, which might not be in their best long-term interests. With an emergency fund at your disposal, you have the breathing space to evaluate and consider the best course of action.

Strategic Planning: Instead of opting for a quick-fix solution, an emergency fund provides you with the opportunity to research, plan, and choose a path that aligns best with your overall financial goals and situation.

How to Build an Emergency Fund

Determine the Appropriate Size:

The size of your emergency fund should be based on your unique circumstances. A common recommendation is to save three to six months’ worth of living expenses. However, if you have dependents, unstable income, or high debt, you may want to aim for a larger fund.

- Start Small: If saving several months’ worth of expenses feels daunting, start with a more achievable goal, such as $500 or $1,000. As you reach these smaller milestones, gradually increase your target.

- Set Up a Separate Account: Open a separate savings account for your emergency fund to avoid the temptation of using it for non-emergencies. This account should be easily accessible, but not too easy that you’re tempted to dip into it for regular expenses.

- Automate Contributions: Set up automatic transfers from your main bank account to your emergency fund each month. Automating this process ensures consistent contributions and removes the need for active decision-making.

- Cut Unnecessary Expenses: Identify areas in your budget where you can cut back, and redirect those funds to your emergency savings. Whether it’s dining out less or canceling unused subscriptions, small changes can add up.

- Allocate Windfalls: Whenever you receive unexpected money, such as tax refunds or bonuses, consider allocating a portion of it to your emergency fund.

- Monitor and Adjust: Periodically review your emergency fund. If your living expenses or family situation changes, adjust the target amount for your fund accordingly.

How to Calculate the Right Amount for Your Emergency Fund

An emergency fund, often considered the financial world’s safety net, protects you from unexpected financial upheavals. However, a question that puzzles many is, “How much do I really need in my emergency fund?” While the answer varies based on individual circumstances, this article guides you through the steps to determine the ideal size of your emergency fund.

Step 1: List Out Monthly Essential Expenses

Before you can determine the size of your emergency fund, identify and list all essential monthly expenses. These should include:

Housing: Rent or mortgage payments.

Utilities: Gas, water, electricity, and internet.

Groceries: Basic food expenses.

Transportation: Fuel, public transport costs, or essential vehicle maintenance.

Healthcare: Regular medical prescriptions or treatments.

Insurance: Health, car, and home insurance premiums.

Debt Obligations: Minimum monthly payments for credit cards, loans, etc.

Others: Any other essentials unique to your situation.

Step 2: Calculate Your Total Monthly Essential Expenditure

Once you’ve listed all your essential expenses, sum them up. This total represents the bare minimum you’d need to get through a month without additional income.

Step 3: Decide on the Duration

Determine how many months of expenses you’d like your emergency fund to cover. A common recommendation is:

Three months if you’re in a two-income household and both jobs are relatively stable.

Six months for a single-income household or if one of the jobs in a dual-income household is unstable.

Nine to twelve months if you’re self-employed, work on commission, or experience irregular income.

Step 4: Multiply Monthly Expenses by Desired Duration

Take your total monthly essential expenditure and multiply it by the number of months you decided upon in Step 3. This product gives you the target amount for your emergency fund.

Step 5: Factor in Additional Considerations

While the above steps provide a basic framework, individual circumstances might necessitate adjustments. Consider:

Health conditions: If you or a family member has a health condition that might result in unexpected medical costs, you may want to save more.

Job market: If your profession has a volatile job market, leaning towards a larger emergency fund could be wise.

Dependents: The more people relying on your income, the larger your safety net should be.

Step 6: Review and Adjust Periodically

As life changes — whether it’s a raise, a new child, or paying off a debt — your monthly expenses and savings goals will shift. Regularly reviewing and adjusting your emergency fund goal ensures you remain adequately covered.

Building an emergency fund is an essential step towards financial security. By taking the time to calculate the right amount tailored to your circumstances, you ensure that this safety net serves its purpose effectively. Remember, it’s not about hitting the target quickly, but about steadily building towards it, ensuring that when life throws a financial curveball, you’re well-prepared to catch it.

The Key Characteristics of an Emergency Fund

As a cornerstone of personal finance, emergency funds acts as a buffer against the unpredictable financial storms of life. But what truly defines an emergency fund? Let’s delve into its key characteristics.

1. Liquidity

Easy Access: An emergency fund should be easily accessible. Remember that you must be able to draw from it without major penalties or waiting periods.

Stable Value: The fund’s value shouldn’t fluctuate like stock market investments. Instead, its worth should remain consistent, ensuring you know exactly how much you have at any given time.

2. Sufficient Size

Covering Essentials: At a minimum, your emergency fund should be able to cover your essential expenses for several months. These essentials might include rent/mortgage, utilities, groceries, and any required medical expenses.

Tailored to Personal Circumstances: Depending on factors like job security, number of income sources, and personal comfort level, the size of an individual’s emergency fund can vary. Some financial experts recommend having three to six months of expenses saved up, while others advise a more conservative approach of up to a year’s worth.

3. Separation from Other Savings

Dedicated Account: An emergency fund should be in its own account, distinct from your regular savings or checking accounts. This separation helps prevent accidental or impulsive spending.

Mental Distinction: By clearly labeling and treating the account as an “emergency only” resource, you mentally cement its purpose, making you less likely to dip into it for non-emergencies.

4. No Associated Debt

Debt-Free: Ideally, the money in your emergency fund should not be linked to any form of debt, like a credit card or a personal loan. It should represent pure, unencumbered savings.

Avoiding Interest Payments: The essence of an emergency fund is negated if you’re accumulating interest on borrowed money. Ensure that your fund is a result of dedicated savings, not borrowed cash.

5. Regularly Reviewed

Periodic Assessment: As life circumstances change (e.g., a change in marital status, having children, or moving homes), so might your monthly expenses. Regularly review and adjust the size of your emergency fund accordingly.

Replenishment: After an emergency withdrawal, prioritize replenishing the fund back to its desired level to ensure continued protection against future unexpected events.

What Can CreditU Do For You?

In today’s fast-paced world, it is crucial to be prepared for unforeseen emergencies. Whether it’s a medical emergency, sudden job loss, or a natural disaster, having an emergency fund can help you cope with unexpected expenses without putting a strain on your finances. That’s where CreditU comes in – an online platform that can help you create and manage your emergency fund along with all your finances.

CreditU makes it easy to get started. All you need to do is create an account, and you’re ready to go. Once you sign up, you can set up a financial goal of saving up for an emergency. CreditU’s innovative features allow you to input all your income, expenses, and debts, giving you a complete overview of your financial situation. This way, you can create a budget and see exactly how much you can put aside towards your financial goal.

CreditU also offers several other features to help you stay on track. You will receive notifications to keep you updated on your progress. Additionally, the platform provides financial education that can help you make informed decisions about your money. CreditU also offers encouragement along the way, which can help you stay motivated to achieve your financial goals.

CreditU is an excellent tool for anyone looking to create an emergency fund. With its easy-to-use interface, comprehensive financial overview, budgeting tools, and added features, you can be prepared for any unforeseen emergency that may come your way.

Key Insights – Building an Emergency Fund

1. An emergency fund isn’t just about saving money. It’s about peace of mind and keeping our financial goals on track, even when life throws us a curveball

2. An emergency fund should ideally cover 3 to 6 months of living expenses

3. Some good characteristics of emergency funds are

- Ease of access

- Covering a possible 3-6 months of essential expenses

- Separate from other savings

- Should not be linked to any form of debt

- And periodical reviews for circumstance and other lifestyle changes

Last Updated on January 11, 2024 by Dilini Dias Dahanayake