Where Can I Get Financial Help?

July 11, 2023

In today’s financial landscape, stability can be hard to come by. Many people face the daunting tasks of managing substantial debt and juggling multiple credit lines, often feeling isolated in their struggles. But there’s plenty of help around that includes solutions such as debt management, credit counseling, budget management and more. Having access to crucial resources, correct guidance, and strategies to help you navigate away from the pitfalls of debt can help you towards a more secure financial situation.

Topics Covered... Budgeting Help Debt Help Retirement Planning Help Bankruptcy Help How Can CreditU Help Key Insights

Budgeting Help

Budgeting is the golden thumb of good financial management. With a well-thought-out budget it is easy for you to allocate money where you really need. Knowing the ins and outs of your money is the best way to allocate it where it is necessary. The most basic steps to planning and implementing a budget are:

- Define your financial goals including the short- and long-term goals.

- Calculate your income.

- Calculate your expenses.

- Implement and monitor your budget.

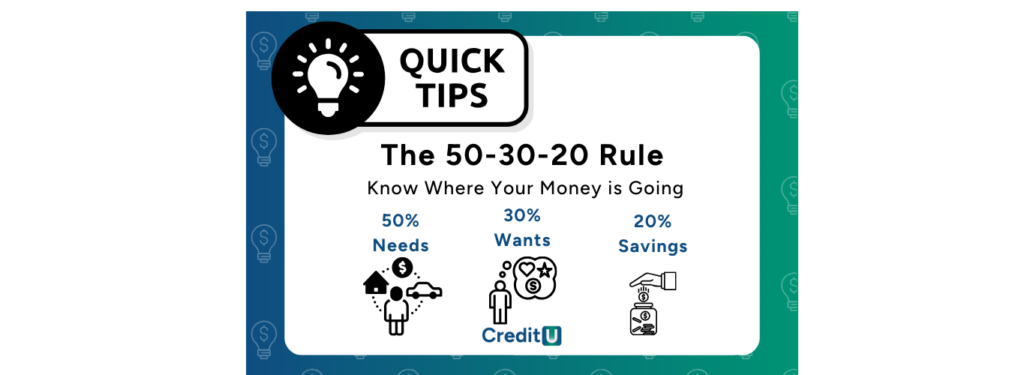

The 50-30-20 rule of budgeting is a great tool to help you. This is where you allocate 50% of your money to your needs, 30% on wants and 20% on savings. Once you have your money allocated to these categories you can:

Achieve Financial Balance: By using a budget, you can have a more balanced perspective. You can make sure you have the money for your essentials, have the money for discretionary expenses and that you are saving for the future.

Prioritize Vital Expenses: When you have a solid budget in place you are able to prioritize your expenses without relying heavily on debt. Because 80% of your money is allocated to needs and wants you are more likely to have your essentials covered.

Have Attainable Saving Goals: You are likely to stay focused on your savings By allocating 20% of your income to savings, you can set up an emergency fund, prepare for retirement, pay off debt, invest, or pursue other financial goals.

Debt help

If you’re struggling to pay off debt on your own, credit counseling is one place to start. With a nonprofit credit counseling agency, credit counselors are certified to evaluate people’s financial situation, including their debt, budgets, and assets. From there, a credit counselor helps you figure out how to rework your budget to pay off debt or presents other options to you. As your credit card debt begins to roll in it can put an intense strain on your personal finances. Having access to resources and understanding all of your options can make the difference between dominating debt and drowning in it. So let’s look at some guidelines on how to dominate debt.

Figure out what you owe – Do not live in denial and allow your debt to pile up. Write down every debt you have as well as the amount you owe. With this information, you can create a plan on how to best go about paying off each debt.

Organization is key – Pull all those bills out of the drawer and get your finances in order. Organization will help motivate you to create a plan to dominate your debt.

Mark your calendar – Create a calendar devoted to payments. Mark when each bill is due on your calendar and cross it off once it has been paid.

Look over your bills – Carefully examine your bills to see if there are ways you can reduce them.

Reduce your spending – Shrink your monthly spending to help you get out of debt at a faster rate. Review your credit card statements to see where your money has been going to each month. Create a budget and stick with it each month.

When To Seek Outside Help

If you have taken all the above steps and you still feel you are not able to pay off your debt, it may be time to seek outside help. A nonprofit credit counseling agency can help. Credit counselors can look at your overall financial picture and determine the best options for you moving forward.

Retirement planning help

Everyone wants to make sure they’re as prepared as possible for their golden years. But knowing exactly what to do can be tricky, since people can have different financial situations. While most people know to contribute to their 401ks or IRAs and to invest, getting guidance from a certified financial planner (CFP) or other financial advisors who practice retirement planning can be advantageous. When you meet with a retirement advisor, you’ll share what your retirement plans are, as well as your whole financial picture, such as your investments, assets, and debts. Based on that, the retirement advisor will create a specific plan for your retirement and advise you on tax considerations. You can look for retirement advisors on places like the CFP Board’s website, the U.S. News Advisor Finder, or the Financial Planning Association. Make sure that the advisor has credentials such as the CFP, the CFA, and the PFS.

Bankruptcy help

For those with overwhelming debt, bankruptcy is another option. If you’re considering filing for bankruptcy, you must complete a credit counseling course with an approved agency – like American Consumer Credit Counseling – first, as required by the law. The credit counseling session is for educating people about the bankruptcy process, evaluating their financial situation, and exploring possible alternatives to bankruptcy. After you complete the counseling session, you will receive a certificate, which is necessary for when you file the bankruptcy petition. Remember – bankruptcy is a last resort. A bankruptcy can stay on your credit report for years, which will make borrowing money in the future harder. Take advantage of credit counseling to either consider another debt solution, or to be fully educated on what to expect with bankruptcy.

How can CreditU help?

With the CreditU app, you can have a holistic view of your finances all in one place. Not to mention all of the resources available to you powered by the expert knowledge of ACCC staff. It can help you create a detailed budget inside CreditU and know where you stand financially no matter where you go. Implementing budgeting principles such as the 50-30-20 rule is made easy with our superior financial management app.

Set saving for retirement and an emergency fund as your financial goals and be able to track them! Link your bank and credit card accounts so that you have all your balances in one place. It’s harder to overspend when you know your balances and have a budget. Click Here to sign up for the CreditU waitlist to get primary access to financial freedom.

At CreditU, we understand that your finances are unique to you. That’s why our app provides recommendations based on your complete financial picture. Plus, you’ll have access to real human counselors! This way, financial help is always within your reach. See you there!

Key Insights – Getting Financial Help

1. Managing your personal finances properly is a crucial part of your personal life. Having access to the right resources and tools plays a major role in the process.

2. Budgeting, debt management, and retirement planning are crucial areas that you may need help with in managing your money accurately.

3. Following basic principles such as the 50-30-20 rule, using superior money management apps such s CreditU can help you organize your finances better to reach your goals.

Back To Top

Last Updated on February 15, 2024 by Dilini Dias Dahanayake