Role of Financial Education In Preventing Debt

March 18, 2024

Financial education can be the difference between being thousands of dollars in debt with no repayment plan and managing debt effectively. Debt management and financial education goes hand in hand. Let’s dive in to what debt is and why financial education is important in preventing debt or more of it.

Topics Covered... Debt Explained Methods to Pay Off Debt Debt Management Program Financial Literacy for All The Importance of Financial Education Benefits of Financial Education Paying Off Debt Quicker Financial Education: Getting Started The Money Talk In Conclusion What Can CreditU Do For You? Key Insights - The Role of Financial Education in Preventing Debt

Debt Explained

What is debt? Debt is an obligation or liability that is owed by one party, the debtor, to another party, the creditor. It usually involves the borrowing of money or goods with the agreement to repay the amount owed with interest or other fees over a certain period of time. Debts can be incurred by individuals, businesses, or governments. It can come in many forms such as loans, credit cards, mortgages, bonds, etc. High levels of debt can be a burden, as they require regular payments and can limit financial flexibility.

Methods to Pay Off Debt

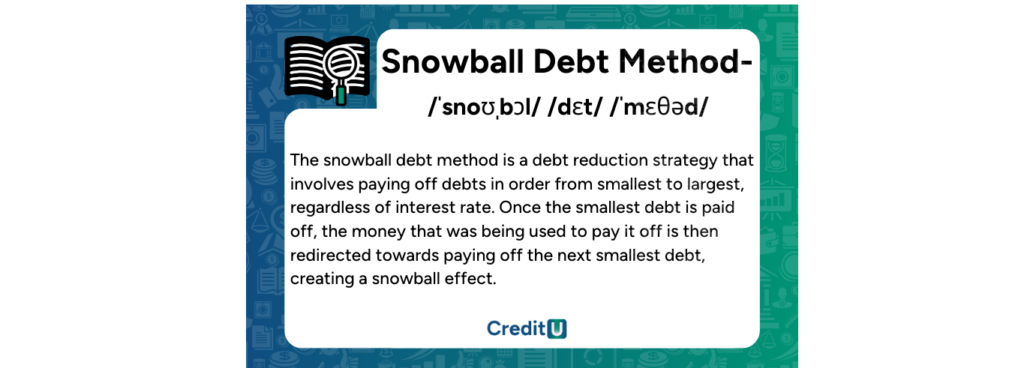

Snowball Method

First, we have the debt snowball method. This is a debt reduction strategy that involves paying off debts in order from smallest to largest, regardless of interest rate. Once the debt with the smallest balance is paid off, the money that was being used to pay it off is then redirected towards paying off the next smallest debt. This method creates a snow ball effect.

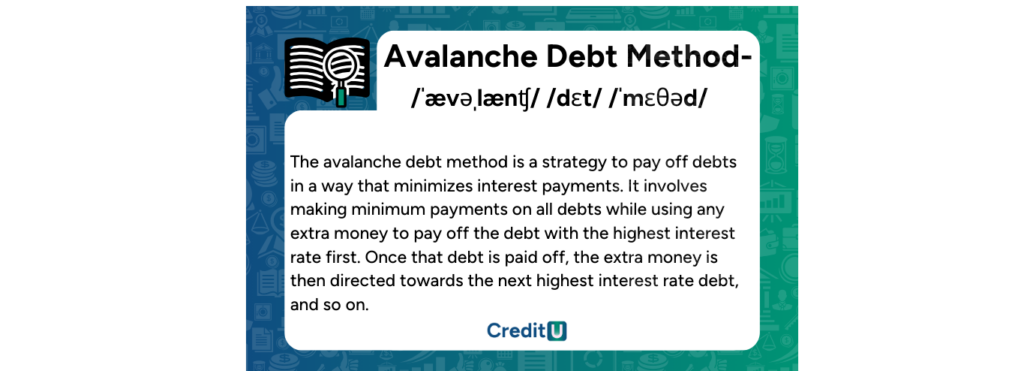

Avalanche Method

Next is the debt avalanche method. The avalanche method is a strategy to pay off debts in order based on interest rates. It involves making minimum payments on all debts while using any extra money to pay off the debt with the highest interest rate first. Once that debt is paid off, the extra money is then directed towards the debt with the next highest interest rate, and so on. This method could save you more money in the long run because you are tackling the highest interest rates first.

Debt Management Program

Having a large amount of unpaid credit card debt can affect your credit score. It’s best to create a plan and start paying it back as soon as you can. Let’s go over a couple of payment methods for debt.

Some people may choose to enroll in a debt management program to get on track paying their debts. A debt management plan is a program designed to help individuals get financially organized and repay their debt within five years. It involves working with a nonprofit credit counseling agency, such as ACCC who can negotiate lower interest rates and monthly payments with creditors. The agency then consolidates all debts into one monthly payment. This then distributed to creditors on the individual’s behalf.

Avoid Bankruptcy

Debt management plans typically last three to five years and can help individuals become debt-free while avoiding bankruptcy. It is important to note that participation in a debt management plan may have an impact on credit scores and may not be suitable for everyone. If you’re interested in in a debt management plan for yourself, it is best that you chose a reputable nonprofit like American Consumer Credit Counseling (ACCC). For information on ACCC’s debt management program, click here.

Financial Literacy for All

Having some level of financial literacy and a basic understanding of debt is vital for all everyone. Without proper financial education, it can be very easy to make a bad money decision that you might not have made if you had financial literacy, such as falling into the hands of predatory loan sharks or signing up for too many credit cards without researching them first. The role of financial education in preventing debt cannot be understated. Financial education can be the difference between having good credit and becoming debt free, or never paying off your debts. Let’s go over what finical education is.

The Importance of Financial Education

Financial education refers to the process of learning how to manage one’s personal finances, including budgeting, investing, tracking expenses, saving, and overall financial planning. It is important because it empowers individuals to make informed financial decisions that can help them achieve their goals, such as buying a home, starting a business, or retiring comfortably. Without financial education, people may struggle with debt, overspending, or lack of savings, which can lead to financial stress and hardship. By understanding financial concepts and strategies, you can improve your overall financial well-being and make better financial choices throughout their lives.

Benefits of Financial Education

One of the primary benefits of financial education is increased financial literacy. Financial literacy refers to an individual’s ability to understand and apply financial concepts. People with financial literacy already know about budgeting, saving, investing, and managing debt. This knowledge helps individuals make informed financial decisions and avoid financial pitfalls.

Better Decision Making

Another advantage of financial education is better decision-making. When individuals have a solid understanding of financial concepts, they are better equipped to make sound financial decisions and create a better personal financial plan for themselves. They can evaluate financial products and services, such as credit cards, loans, insurance policies, and choose the ones that best meet their needs. They can also make informed decisions about investment opportunities and retirement planning.

Financial education can also lead to improved financial habits. With financial education, individuals can learn how to budget effectively, save money, and manage debt. These habits can lead to long-term financial stability, debt freedom, and financial security.

Paying Off Debt Quicker

How can financial education help people pay off debt even faster? Overall, financial education has helped many individuals avoid debt or pay off debt in a timely manner. Here are some examples of how it can help you:

1. Budgeting

Learning how to budget is a fundamental aspect of financial education. The budgeting process helps people track their expenses, income, and savings. By keeping track of their spending, people can identify areas where they can cut back and save money. This allows them to avoid taking on unnecessary debt and to pay off existing debts more quickly.

2. Debt consolidation

Financial education can teach people about debt consolidation, which is the process of combining multiple debts into a single loan or payment. This strategy can help people pay off debt more quickly by reducing their interest rates and monthly payments. Consolidating debt can also help people avoid taking on additional debt by making their payments more manageable.

3. Investing

Financial education can also teach people about investing their money. By investing in stocks, bonds, or other assets, people can earn additional income that can be used to pay off debts. Additionally, investing can help people build wealth over time, which can help them avoid debt in the future.

4. Negotiating with creditors

Finally, financial education can teach people how to negotiate with creditors to reduce their debts. Negotiating can involve asking for lower interest rates, requesting a payment plan, or settling debts for less than what is owed. By negotiating with creditors, people can reduce their debts and avoid taking on additional debt in the future.

Financial Education: Getting Started

Getting started with financial education doesn’t have to be complicated. These 4 tips can help you reach your financial goals and begin your financial education journey:

1. Take a personal finance class or workshop.

Some available may make you pay but there are plenty of free classes or webinars out there. If you yourself want to increase your financial knowledge, try checking out a nonprofit like ACCC’s free financial literacy webinars. Click here to see a list of upcoming webinars and their topics.

2. You can also read credible personal finance blogs.

Though there is plenty of financial education online, you should also make sure you’re looking at reputable sources. Since anyone with a computer and internet access can create a blog, please do some research on the creator of the blog before you start reading their content. Most blogs will have an about me section where you can read a blurb about the creator. If it’s a guest author, there will more than likely be a bio paragraph at the end of the post.

3. Read personal finance books.

Your local library can yield tons of financial education materials for free! Talk to one of the librarians (look for a reference librarian) to get you pointed in the right direction. Some libraries even offer classes. Ask for a class schedule to see if there are any financial literary classes being taught there soon.

4. You can even seek out a financial advisor or mentor.

Speaking to a financial advisor can be a bit pricey, so unless you have the budget for this, you may want to look for other options. Alternatively, you could look for a mentor rather than hiring a financial advisor. This could simply be a friend of family member that is great with money, that can help teach you how to get on track with yours.

The Money Talk

Lastly, can you recall having a conversation about money and finances with a parent or guardian when you were younger? Did anyone sit you down an explain how to properly use credit cards? How did you learn about debt and how to manage it? Did anyone teach you, or did you learn on your own? Financial education plays a vital role in preventing debt. After all, it’s hard to prevent debt if you’re not aware of the ways you could be pulled into it. Take the time to invest in financial education for yourself and your family.

In Conclusion…

Financial education is a powerful tool that can help prevent debt and improve overall financial well-being. It is essential to understand the basics of budgeting, saving, and investing to make informed financial decisions. Many people struggle with debt due to a lack of financial knowledge and education. By learning how to manage money effectively, you can avoid debt and secure their financial future.

What Can CreditU Do For You?

Use CreditU as a tool to assist you in your journey to a debt free life! Have your personal finances in the palm of your hands.

With CreditU you can obtain personalized financial education.

Get debt management advice for your specific situation.

Use CreditU to create budgets and track your expenses.

Start a financial goal to pay off your debt, make sure you select a reasonable time frame.

Let CreditU encourage you to reach your debt free financial goals!

CreditU is now available to download on the app store, click here for more information.

Key Insights

1. Debt is an obligation or liability that is owed by one party, the debtor, to another party, the creditor.

2. Snowball and avalanche are debt repayment methods.

3. A debt management plan is a program designed to help individuals get financially organized and repay their debt within five years.

4. Financial education can be the difference between having good credit, becoming debt free, or never paying off your debts.

5. Financial education refers to the process of learning how to manage one’s personal finances, including budgeting, investing, and saving.

6. Financial Education helps individuals make informed financial decisions and avoid financial pitfalls.

7. When individuals have a solid understanding of financial concepts, they are better equipped to make sound financial decisions.

8. With financial education, individuals can learn how to budget effectively, save money, and manage debt. These habits can lead to long-term financial stability and security.

Last Updated on March 18, 2024 by Dilini Dias Dahanayake