Teaching Your Kids About Money

July 4, 2023

Financial literacy is an essential life skill, yet it’s often overlooked in formal education. Just as we teach our kids how to tie their shoes or cook a meal, it’s equally important to give them the knowledge about money management. Here’s a complete guide on teaching kids about money. Different age groups need a different approach to learning about money. Here is a breakdown of how as parents you can approach different age groups to teach your kids about money.

Most schools in the U.S. don’t teach financial literacy. If you’re a parent or guardian, teaching your kids about financial literacy is crucial. Financial literacy helps empower kids to manage their finances and make wise decisions in the future. To get started, here are some concepts to teach based on your kids’ age.

Topics Covered: Teaching Your Kids About Money - What to Do at Each age? K-2 Age Range Grades 3-6 Grades 7-12 Teaching Your Kids About Money - Tips for Parents Jobs for All Ages Tweens & Teens What Can CreditU Do For You? Key Insights

Teaching Your Kids About Money – What to Do at Each Age?

K-2 Age Range

The first thing kids should know about money is that it comes from work, and that everyone only has a limited amount of it. This should help your child realize why you can’t buy every single toy or treat they see.

Once your child understands that money (sadly) doesn’t just come out of thin air, you can teach them the concept of working for their money. For example, they can do chores around the house in exchange for whatever price you see fit. Just make sure to clearly outline which chore is pay-worthy and which ones are basic, expected responsibilities. After they earn their money, the next concept is teaching them to keep their money in a bank. This could be a piggy bank in their room, or if you want to expose them to “real-world” banking, you can open a savings account for them.

Grades 3 – 6

By now, your child is probably more interested in buying things to enjoy for themselves. From video games to clothing and makeup, the list goes on. But before that list gets too long, remind them to make smart choices with their finite amount of money. That’s where saving and planning comes into play. Have your kids make a list of what they need or want, then let them rank these items based on importance. Then, take their lists and show them the estimated costs of each item. Seeing the numbers on paper will help them make smart choices, and teach them the importance of setting a goal with savings.

Grades 7 – 12

It’s time to introduce the concept of credit cards. Be sure to emphasize that they aren’t magical pieces of credit. Credit cards have due dates, as well as terms and conditions to follow. Explain to your kids that if they don’t pay their credit card bills on time, they could end up with serious credit card debt problems down the line.

To give kids under the age of 18 a basic understanding of how credit works, they can practice using credit by borrowing money from their parents. You can set up a limit, repayment terms and a standard interest rate to familiarize them with what comes with a credit card. If they miss a payment, charge them a small fee. Yes, you might hear some grumbling at first, but they’ll learn the cost of credit. This will instill in them the habit of paying on time. Furthermore, this helps them learn the basics of credit before mistakes can harm their credit report and score.

Teaching Your Kids About Money Tips – How to Handle Kids Allowances

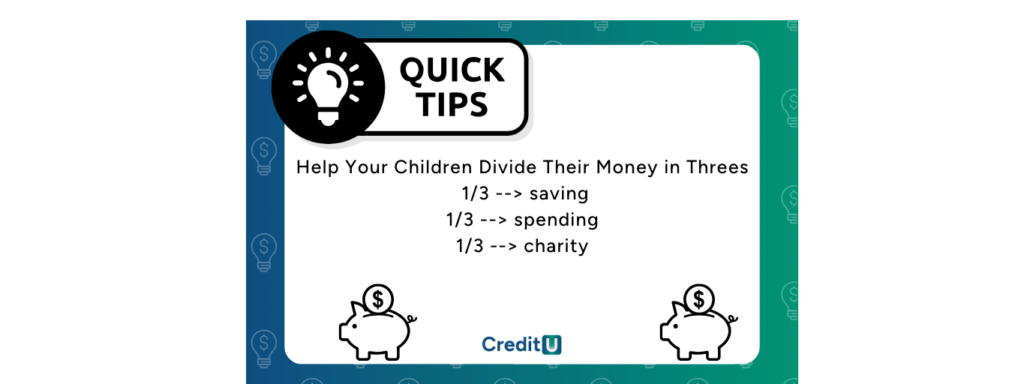

Part of financial education for kids is helping them understand the value of a dollar. The best way to do this is for them to earn their own money and learn money management skills through practice. A good option for parents is to do this through allowances. Some parents choose to have their children earn money outside of the house. You can also do a combination of both.

Jobs For All Ages

- Allowance – This is a great tool to give your children incentive to help out around the house. In exchange for a few chores, award your children a few dollars a week. As they get older, they can take on more difficult chores, like laundry or heavy cleaning. More difficult chores, like lawn maintenance or snow removal, can command a heftier dollar amount, if you choose.

- Recycling – Can returns may be only five cents a can, but those can add up quickly. It requires hard work and effort, but it shows kids the value of keeping the earth green and persistence.

- Lawn care – A great way to help a neighbor and to earn some extra cash is to offer services like raking, lawn-mowing, or weeding. In the wintertime, they can shovel snow.

- Pet sitting – When neighbors go away over the summer, they’ll need someone to feed their fish or cat. It’s a good way to show children the responsibilities associated with pets, as well as help them understand the value of an earned dollar.

- Sell lemonade or baked goods – Give your kids a small loan for supplies (with understanding that you’ll get paid back before they take a profit for themselves) and help them set up a lemonade stand or baked good stand. They’ll learn the business of selling and communicating with potential customers. Be sure to supervise all sales transactions and any interactions.

For Tweens and Teens

- Babysitting –Depending on your child’s age and maturity, kids can earn anywhere from $10 – $20 an hour from a babysitting job.

- Recreational activities/tutoring lessons – If your child meets the minimum age and labor laws criteria get them to get them involved in soccer coaching or tutoring. This can help enhance their skills and knowledge while earning some extra cash.

With any of these activities, it’s important to make sure your children are doing this safely. Supervise any business arrangements and stay in the loop.

Teaching your kids about financial literacy is one of the most valuable things you can do as a parent or guardian. Be sure to remind them that learning about financial literacy doesn’t stop after high school, either. In fact, at CreditU, we encourage adults to keep learning too! With our articles, videos, and so much more, you can become financially empowered. Happy learning!

What Can CreditU Do For You?

Teaching children about financial literacy is an important aspect of parenting, and downloading a finance app like CreditU can be a great way to help in that process. CreditU is an app that offers a user-friendly interface and a range of financial tools to help users manage their finances, set budgets, and monitor their credit score.

CreditU isn’t just for finance pros, the app offers personalized financial literacy tailored to your specific financial situation; like a teenager that just got their first job that needs to learn the ends and outs of budgeting and saving. You can show them how to use the app to track their spending and explain how budgeting works. You can also use CreditU to teach them about the importance of saving money and the different ways they can save. Show them how to create and track financial goals.

CreditU can be a tool to assist you in teaching your children about financial literacy. By using the app together and having open conversations about money management, you can help your children develop the skills they need to make smart financial decisions in the future. Download CreditU today!

Key Insights – Teaching Your Kids About Money

1. Start Early: It’s never too premature to initiate financial education. Starting at a young age ensures children internalize important money principles as they grow.

strong

2. Isn’t Infinite: Especially for very young children, understanding that money isn’t an endless resource and must be earned through work is fundamental.

3. Differentiate Between Responsibilities & Earning Opportunities: It’s crucial to teach kids the difference between tasks they do as part of the household and those they perform to earn an allowance.

4. Budgeting & Prioritization: As children grow, they should learn to recognize needs from wants. Also understand making choices is a way of life and money is a limited resource.

5. Goal-Oriented Savings: Having a savings goal can make the act more purposeful and fulfilling for kids, highlighting the value of patience and discipline in financial matters.

6. Credit Isn’t Free Money: Before they become adults, kids should understand the complexities of credit, including interest rates, repayment conditions, and the consequences of late payments.

7. Open Conversations Are Key: Discussing future financial challenges and needs, such as college expenses, ensures children are prepared for real-world financial responsibilities.

8. Reinforce, Reinforce, Reinforce: Continuous education about saving, spending wisely, and understanding credit will ensure lessons are ingrained and habits formed.

9. Financial Literacy is Empowering: Providing kids with the tools and knowledge to make informed decisions about money sets them up for a more financially stable and confident adulthood.

Back To Top

Last Updated on January 11, 2024 by Dilini Dias Dahanayake