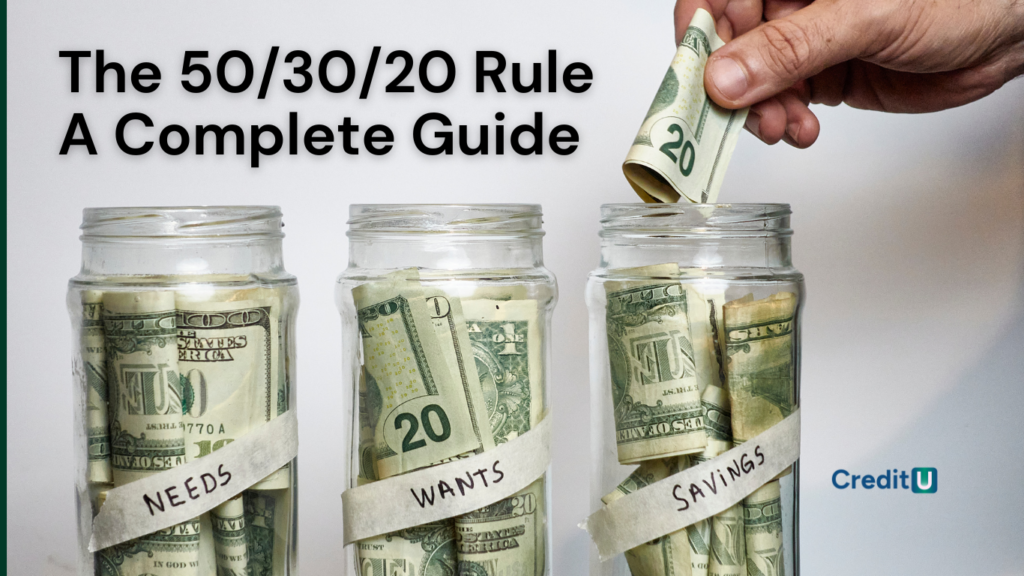

The 50/30/20 Rule of Budgeting: A Deep Dive

January 2, 2024

Navigating personal finances can be daunting. But strategies like the 50/30/20 rule of budgeting stands out for its simplicity and efficacy. This method not only helps in managing your current financial situation but also helps secure a better financial future. Let’s dive deeper into each segment of the rule and explore strategies for optimizing your budget.

Topics Covered: Understanding the 50/30/20 Rule in Detail Optimizing Your Budget With The 50/30/20 Rule Challenges and Considerations How Can CreditU Help? Key Insights

Understanding the 50/30/20 Rule in Detail

The 50/30/20 budgeting rule divides your after-tax income into three distinct categories:

Essentials / Needs (50%)

Needs are the backbone of your budget. These are the absolute must-haves for survival and basic comfort. Some examples of needs are:

- Housing: Whether it’s rent or a mortgage, keep this within 25-30% of your income if possible.

- Utilities: Includes electricity, water, gas, and necessary phone services.

- Groceries: This is about food on the table, not dining out.

- Transportation: Car payments, fuel, public transit passes, and necessary maintenance.

- Insurance: Health, auto, and any other insurance premiums.

- Minimum Debt Payments: The least you need to pay to keep accounts in good standing.

If these necessities reach over the 50% threshold, it’s a signal to reassess and find areas to trim. This could mean downsizing your living space, refinancing loans, or even as simple as using public transportation.

Wants (30%)

Your wants are the quality-of-life expenses that bring you joy and entertainment. These are essentially nice to have things in life and should ideally be the first things to consider if you are tight on your finances.

- Dining Out and Takeaways: Includes all restaurant meals and coffee runs.

- Leisure and Entertainment: Subscriptions, movies, concerts, and other activities.

- Shopping: Non-essential clothing, gadgets, and personal items.

- Travel: Vacations, weekend getaways, and travel for pleasure.

To prevent overspending in this category, set limits for each sub-category and stick to them. Consider experiences over possessions, as they often bring more lasting happiness.

Savings (20%)

This category is your financial growth engine and includes things such as:

- Emergency Fund: Aim for 3-6 months of living expenses, more if your income is variable.

- Retirement Savings: Contributions to a 401(k), IRA, or other retirement accounts.

- Investments: Stocks, bonds, mutual funds, or other investment vehicles.

- Extra Debt Payments: Anything above the minimum to pay down debts faster.

Automating your savings can help make this step thought-free. Treat your savings contribution like a bill that must be paid each month.

Adapting the 50/30/20 rule in your personal finance journey can help you get financially organized and stay on track.

Optimizing Your Budget with the 50/30/20 Rule

The 50/30/20 rule is a useful strategy to optimize your finances. Your budget can be much more structured and focused by adapting this strategy. Here are some tips to optimize your budget using the 50/30/20 rule.

Analyzing Your Spending Habits

Track your spending for a month or two to see where your money is going. Use budgeting apps such as CreditU to categorize your expenses. This will highlight areas where adjustments are needed and get your budget on track.

Adjusting for Reality

Your situation might require you to alter the standard 50/30/20 allocations. If you live in an expensive city, the essentials might take up more of your income. Conversely, if you’re in a low-cost area or have a higher income, you might be able to save more than 20%. Making informed decisions to match your financial situation and living conditions is what any financial strategy is about. 50/30/20 is framework you can adapt to suit your situation.

Addressing Debt

If you’re heavily in debt, consider a modified 50/20/30 rule where you allocate more towards debt repayment and less towards wants. This can accelerate debt freedom and reduce the amount paid in interest.

Setting Financial Goals

Use the 50/30/20 rule as a framework to set and achieve financial goals. Whether it’s buying a house, starting a business, or saving for a child’s education, allocate funds within your budget to reach these goals. At the end of the day, your financial goals sets your course for the future.

The Role of Financial Tools

Financial tools like high-yield savings accounts, budgeting apps, and automatic transfers can aid in adhering to the 50/30/20 rule. Use these tools to make managing your finances easier and more efficient.

Review and Adjust Regularly

Life changes, and so should your budget. Regularly reviewing and adjusting your budget ensures it continues to meet your needs and goals. Annual reviews are a must, but consider a check-up after any major life event.

Challenges and Considerations

Like in any situation , there are challenges and considerations when it comes adapting any personal finance strategy. Being aware of these challenges and taking precautions to overcome them successfully.

Inconsistent Income

For those with variable incomes, such as freelancers, the rule can be harder to apply. In these cases, base your budget on your average income, or budget month-to-month. Either way, the important thing is that you prioritize your needs and wants to fit your financial situation.

High Cost of Living

In high-cost-of-living areas, the 50% for needs may be insufficient. You may need to adjust the rule to fit your circumstances, potentially by finding creative ways to reduce costs or increase income.

Psychological Factors

Budgeting isn’t just about numbers; it’s also psychological. The 50/30/20 rule can help by providing a clear structure that still allows for treats and luxuries.

Long-Term Financial Health

While the 20% savings might seem sufficient, consider increasing this if you’re able to. The more you save now, the more comfortable your retirement years will be.

What Can CreditU Do For You?

Managing your finances can be a challenging task, especially if you are not sure where to start. Thankfully, CreditU, our all-new finance app, is here to help you create the perfect budget for your financial situation. With CreditU, you can quickly and easily set up a budget that is tailored to your specific needs and goals. Adapting financial strategies such as the 50/30/20 rule is made easy with our money management app. The app provides you with a clear and concise overview of your income, expenses, and savings, making it easy to stay on top of your finances.

One of the most significant benefits of using CreditU is its ability to help you set and maintain financial goals and structure your budget. Whether you are saving for a down payment on a house, saving up for a wedding, planning for retirement, or simply trying to build up your emergency fund, the app makes it easy to create and track your progress towards your goals. You can monitor your progress and make adjustments as needed to ensure that you stay on track.

Overall, CreditU is an excellent tool for anyone looking to take control of their finances. With its intuitive interface, customizable budgeting tools, and powerful goal-setting features, the app makes it easy to create a budget that works for you and to stay on track towards your financial goals. So why wait? Download CreditU today and start taking control of your financial future!

Key Insights – The 50/30/20 Rule of Budgeting

- The 50/30/20 rule is more than a budgeting tactic; it’s a philosophy that encourages a balanced approach to managing money.

- It’s about living within your means while still enjoying life and investing in your financial future.

- Like any good financial plan, it requires customization, discipline, and regular review.

- By adopting the 50/30/20 rule, you can build a stable and flexible financial foundation that will serve you well through all of life’s stages.

Back To Top

Last Updated on January 11, 2024 by Dilini Dias Dahanayake