Back-to-School Shopping Tips

August 3, 2023

Back-to-school shopping can be an exciting time for students and parents alike. However, it can also be a financially stressful time, especially if you have a tight budget. With school supplies, clothing, books, and other expenses piling up, it’s easy to overspend and end up in credit card debt. That’s why it’s important to plan ahead, save up money, and budget your back to school shopping. By doing so, you can save money, avoid debt, and start the school year off on the right foot. In this article, we’ll explore some tips and tricks for budgeting and saving on back to school shopping, so you can have a stress-free and enjoyable shopping experience. Let’s start the school year off right!

Topics Covered... Establishing A Shopping Budget Prioritizing Needs Over Wants Saving Money Free or Used Supplies CreditU Financial Goals Feature Key Insights- Back-to-School Shopping Tips

Back-to-School Shopping Tips

1. Establish A Shopping Budget

Begin putting money aside ahead of time for school shopping. Before you start shopping, make a list of everything you need. This will help you stay organized and avoid impulse purchases. Some schools will even have a shopping list prepared for you. Check with the school by calling or visiting the school’s website. Set a budget for your back to school shopping and stick to it.

Consider setting a limit for each category and prioritizing essential items over luxuries. For example, if your child needs a new backpack, it may be more important to invest in a high-quality backpack that will last for several years rather than a trendy one that will only last for a season. Similarly, when it comes to clothing, consider purchasing items that can be mixed and matched to create multiple outfits rather than buying a lot of individual pieces.

2. Prioritize Needs Over Wants

To set expectations with your kids around back-to-school shopping, it’s important to discuss needs vs wants. Explain that everyone has to focus on the needs first, since it would be challenging to get through a school day without them. If your budget allows, you can give your kids money for one fun thing each. This could make it easier for them to stick to the list of needs, instead of asking for every extra thing they see. Or, if you’re able to shop without your kids, that’s also guaranteed to save you money (and probably stress!)

3. Saving Money

In addition to comparing store and brand prices, shop online for possible promotions or deals. You can also find discounts and coupons on reputable websites like Coupon.com and RetailMeNot. Stay in touch with your favorite stores! When you follow their social media accounts or sign up for their newsletters, you’ll receive news about any discounts or promotions they may do. Many retailers offer back to school sales, discounts, and promotions. Plan it out. However, be careful not to fall into the trap of buying something just because it’s on sale. Stick to your list and avoid impulse purchases.

Make a note of which stores you want to go to and who has what. Nowadays most sales papers are digital so you could clip them to your digital shopping list or screenshot them to help you stay on track. Look at second-hand stores in person or online for things like backpacks and clothing. Take advantage of sales tax holidays if there’s any in your state, too. A sales tax holiday is a temporary period of time during which certain goods and products are exempt from state and/or local sales taxes. These holidays are usually timed to coincide with the back-to-school shopping season or other important shopping periods, like the winter holidays. Essentially it is all about getting financially organized to meet these additional expenses.

4. Free Or Used Supplies

You might even be able to find free school supplies, too. Try asking friends or family if they have extra or gently used items, or check out Facebook Marketplace. If you’re in a low-income situation, the Salvation Army can help. It’s also easy to find organizations online for supplies, such as United Way and Operation Backpack.

One way to save money on textbooks is by buying used books or borrowing them from the library. Used textbooks can be significantly cheaper than new ones, and borrowing them from the library can be even more cost-effective. Additionally, look for sales or discounts on items you need.

The start of a school year can be chaotic, but we hope these back-to-school shopping tips make it easier! At CreditU, we understand that in addition to paying for school supplies, parents have to think about how to finance larger expenses for their children’s long-term success, such as college. With our app, you can plan for both your short-term and your long-term goals.

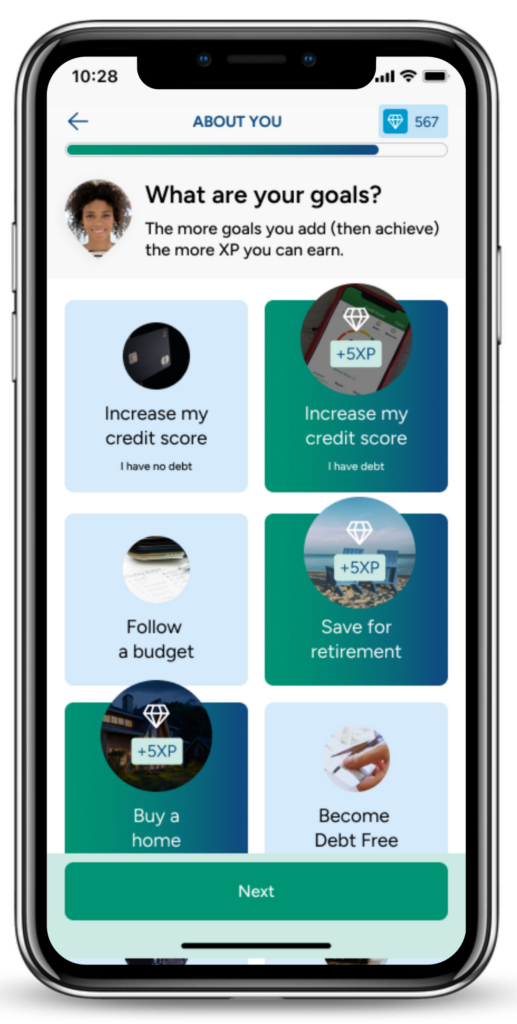

CreditU Financial Goals Feature

In the CreditU app, users can set and track financial goals. Input the goal, how much you want to save, and when you’d like to have the money saved by. It’s not just long term goals like saving up for college, but short term goals like saving up for a vacation. Consider downloading the CreditU app and creating a financial goal of saving up a certain amount of money for the next school year. Start contributing to your goal this spring and have a certain amount of money saved for back to school shopping by August!

Key Insights- Back-to-school shopping tips

1. Back-to-school shopping can take a larger toll on your finances than you may think.

2. It is important that you set expectations with your kids around back-to-school shopping, it’s important to discuss needs vs wants.

3. There can be plenty of free resources available and you can get to them with a little bit of research in your local communities.

4. Make sure you are still aligned with your financial goals while making the spending choices.

Back To Top

Last Updated on January 11, 2024 by Dilini Dias Dahanayake