Tips to Living Below Your Means

August 24, 2023

In today’s fast-paced and consumer-driven society, living beyond one’s means has unfortunately become all too common. But the benefits of living below your means outweigh any of the discomforts you may face in the process. From peace of mind to achieving long-term financial goals the importance of this concept cannot be overstated. Let’s dive into seven actionable tips to help you spend less than you earn and cultivate a financially responsible lifestyle.

Topics Covered... Debunk the Myths About Living Below Your Means 7 Tips to Live Below Your Means What Can CreditU You Do For You? Key Insights - Tips to Live Below Your Means

Debunk the Myths About Living Below Your Means

When we talk about living below our means, it’s not uncommon for people to have a range of preconceived notions about what that truly entails. These misconceptions can deter individuals from embracing a more sustainable and financially responsible lifestyle. Let’s debunk some of these myths:

Myth 01: It Means Living a Deprived Life

One of the most prevalent misconceptions about living below your means is the image it conjures up—threadbare clothing, refusing every social outing, or never allowing oneself any form of pleasure or indulgence. This perception paints a picture of a lifestyle bordering on moderation. It’s far from the truth. Let’s look at a real-life scenario:

Dining Out or Dining in

Jane, is a 30-something professional who loves dining at gourmet restaurants. Before she adopted the principle of living below her means, she’d dine out multiple times a week, racking up a significant bill by month’s end.

But, instead of eliminating her love for good food, she decided to make an informed choice. She began experimenting with recipes at home, occasionally inviting friends over for a home-cooked gourmet meal. Not only did she discover a new hobby, but she also reduced her dining expenses dramatically. Now, she dines out only on special occasions, making those outings feel even more special.

Jane didn’t deprive herself of the joy of gourmet food; she simply found a more cost-effective way to enjoy it, saving money and gaining the satisfaction of cooking for herself and her friends.

Living below your means isn’t about constantly saying “no” to yourself or living a deprived life. It’s about being intentional with your choices. It means saying “yes” to long-term financial freedom and finding innovative ways to enjoy what you love without breaking the bank. It’s about discerning between fleeting pleasures and lasting contentment, choosing the latter whenever possible.

Myth 02: Only Those with Low Income Need to Live Below Their Means

Income level doesn’t dictate the need to live below one’s means. In fact, there are countless stories of high earners who end up in financial distress because they consistently outspend their substantial incomes. Everyone, regardless of income, can benefit from spending less than they earn.

Fact: Spending less than you earn is good for everyone. It’s not just about how much money you make.

Here are some examples of real life situations for you to understand why this is a misconception:

-

Famous People’s Money Woes: Some celebrities make millions but still end up broke. Why? They spend it on fancy cars, big houses, and expensive parties. Just because they earn a lot doesn’t mean they can’t run out of money.

-

The Doctor’s Problem: Imagine Dr. Smith, a new doctor with a good salary but also big student loans. She buys a fancy car and goes on pricey vacations. After a while, she finds that, even with her big paycheck, she’s always waiting for the next one and can’t save much.

-

The Tech Business Owner’s Slip-Up: Mr. Jones sells his tech company and gets $10 million. He thinks it’ll last forever. He buys houses around the world and takes big risks with his money. A few bad choices, and soon he’s running out of cash.

It’s not just about how much money you get, but how you use it. Being careful with spending is smart for everyone, no matter how much they earn.

Myth 03: It’s Only a Temporary Solution

Some believe that living below one’s means is something to be done only during tough times, like a job loss or financial crisis. While it’s especially critical in those situations, it’s a habit that offers long-term benefits, like reduced financial stress and increased savings for the future.

While adhering to a frugal lifestyle during tough times is undeniably beneficial, the philosophy of living below one’s means should not be viewed as a temporary strategy. Instead, it’s a sustainable way of life that, when practiced consistently, yields long-term rewards.

Let’s look at some relatable examples across different walks of life.

-

Emma, fresh out of college, lands her first job with a decent starting salary. Excited, she’s tempted to lease a new car and move into a high-end apartment. Instead, she chooses a used car and shares an apartment with a roommate. Ten years later, not only has Emma advanced in her career, but she’s also accumulated significant savings. These funds allow her to make a down payment on a house, travel, and even take career breaks without financial strain.

-

Mark, in his mid-40s, enjoys a comfortable salary. When his peers are upgrading to bigger homes and taking luxurious vacations, he continues to live in his modest home and opts for local holidays. As retirement nears, while many of his peers are concerned about their financial futures, Mark finds himself well-prepared. His house is nearly paid off, and he’s amassed a sizeable retirement fund, ensuring a comfortable and worry-free post-retirement life.

-

Aisha has a vision and starts her own business. While she begins to earn a good income, she resists the allure of an extravagant lifestyle, reinvesting most of her profits back into her business and maintaining her modest living standards. Years later, when her business faces a downturn, Aisha is not overly stressed. Her prudent financial decisions allowed her to weather the storm without resorting to heavy loans or significant personal financial sacrifices.

In essence, while living below one’s means can be a savior during crises, its real strength lies in the peace of mind, freedom, and opportunities it provides in the long run.

Myth 04: It Means Never Spending on Luxuries

Living below your means doesn’t equate to never treating yourself. It’s about balance. For instance, if you’ve budgeted for a vacation or a special purchase, and it doesn’t put you into debt or financial strain, there’s no reason you shouldn’t indulge responsibly.

Fact: Living below your means is about strategic spending, not total deprivation.

Some relatable examples will help understand this a little better:

Imagine Sarah, a young professional who loves designer handbags. Instead of impulsively buying every new release, she sets aside a certain amount from her paycheck each month into a “luxury fund”. After several months, she has enough to purchase that coveted handbag without incurring debt or sacrificing essential expenses.

Consider Alex and Jordan, a couple passionate about travel. They dream of visiting the Maldives but are wary of the expenses. Rather than charging the trip to a credit card and worrying about it later, they create a dedicated savings plan. They opt for budget-friendly activities throughout the year, skip a few pricey dinners out, and within a year, they’ve saved enough for their dream vacation.

Richard, a music enthusiast, has always wanted a high-end sound system for his home. Instead of opting for a pricey monthly installment plan that would strain his budget, he shops during sales, looks for slightly older models, and even considers refurbished systems. By being patient and shopping wisely, he’s able to buy that sound system without compromising his financial well-being.

In essence, living below your means is about making deliberate choices. It doesn’t mean you should never indulge in life’s luxuries. It means when you do, it’s a result of planning, saving, and ensuring that your indulgences are in harmony with your financial goals and well-being.

Myth 05: All Debt is Bad

Not all debt is created equal. While it’s essential to avoid high-interest debts like credit card balances, other forms like mortgages or student loans can be considered investments in your future. The key is to manage and prioritize repayments efficiently.

Let’s debunk this myth with some real-life scenarios:

Credit Card Debt

Imagine you’ve just splurged on a luxury vacation, charging everything to your credit card with the idea of “I’ll pay it off later.” Months pass, and the outstanding balance accrues a high interest. This kind of debt can quickly spiral, creating a hole that’s hard to climb out of credit card debt, especially when not paid off promptly, can be detrimental due to its typically high interest rates.

Jane, a 28-year-old marketing executive, impulsively booked a two-week European tour on her credit card. On her return, she only managed to pay the minimum amount due each month. Over the year, her debt, with interest, grew significantly, creating a financial burden.

Mortgages

On the other hand, let’s talk about mortgages. A mortgage allows you to purchase a home – a tangible asset that often appreciates in value over time. By consistently paying your mortgage, you’re also building equity in your home, which can be leveraged for other financial opportunities.

Carlos and Ana, a young couple, decided to buy a home. They took on a 30-year fixed mortgage. Over the years, not only did the value of their home appreciate, but they also built equity, which they later used to fund their children’s education.

Student Loans

Education can be a ticket to better job opportunities and personal growth. While student loans are a form of debt, they’re an investment in your future earning potential.

Raj pursued a master’s degree in computer science, funded partly through student loans. While he graduated with debt, the skills and credentials he acquired helped him land a high-paying job. With careful budgeting, Raj prioritized his loan repayments, viewing them as an investment that led to his increased earning capacity.

The essence of understanding debt is recognizing its nature. While reckless spending and accumulating high-interest debt can be financially damaging, strategic, and purposeful borrowing, like mortgages or student loans, can be steppingstones to a brighter future. The key lies in being discerning, responsible, and prioritizing repayments.

Myth 06: Frugality is the Same as Stinginess

While frugality means being prudent and cautious with spending, stinginess has a negative connotation of being overly tightfisted, sometimes at the expense of basic needs or generosity to others. Being frugal can mean maximizing value, while being stingy often implies an irrational fear of spending.

It’s easy to confuse frugality with stinginess, but they’re fundamentally different in intent and practice. Let’s explore the distinction through real-life scenarios.

Frugal or Stingy?

Jane is an avid reader. Instead of buying every new book she’s interested in, she opts for borrowing them from the library or swaps with fellow readers. On occasions where she really loves a book and knows she’ll read it multiple times, she’ll purchase it, often looking for a gently used copy to save money. By making these choices, Jane maximizes the value she gets from her love of reading without spending unnecessarily.John, on the other hand, also enjoys reading. However, when his friend asks if they can borrow one of the books he’s finished with, John hesitates and makes excuses, fearing he’ll lose something in the process, even though he has no intention of re-reading the book. This isn’t about maximizing value; it’s an irrational fear of parting with an item, even temporarily, even if it costs him nothing.

In essence, while frugality celebrates making informed, value-driven choices that enhance one’s quality of life without needless expenditure, stinginess stems from an undue anxiety around parting with resources, often at the detriment of oneself and others.

Living below your means is a dynamic concept that’s adaptable to individual lifestyles and financial goals. It’s essential to approach it with an open mind, free of misconceptions, to harness its true benefits.

7 Tips to Living Below Your Means

Often due to many socio-economic reasons individuals tend to live beyond their financial capacity. However, the rewards of adopting a lifestyle where you consistently spend less than you earn has a direct correlation to financial independence. Here are seven thoughtful strategies to help you with living below your means.

1. Know Your Money

Knowing the ins and outs of your finances is the foundation to the success of good financial management. Understanding where you stand financially is the first step to living below your means. How much is coming into your household vs how much s going out? Is there room for savings?

Maintain a Financial Log: Using money management apps such as CreditU, you can conveniently track every dime that comes in or goes out. This helps in painting a clear financial picture. This is your basic knowledge about your financial limitations.

Draft a Comprehensive Budget: Be thorough. Look at your fixed and variable expenses and each source of income in your budget. Allocate an allowance for emergency savings and investments.

2. Separate Wants from Needs

Separating your needs and wants is another essential step to live below your means. Not having this clarity can send you on winding road in your financial journey. There are a couple of ways to go about this. What is your absolute must haves to live your life? These are your basic needs. Beyond that anything else is nice to have. What are the extents you would go to fulfil your nice to have things in life? When would you draw the line?

Focus on the Basics: Essential categories like housing, utilities, basic nutrition, commuting, and primary health care shouldn’t be compromised. These are essential to lead a healthy lifestyle.

Practice Pause Before Purchase: Give yourself a window before buying. This strategy works often and can prevent you from any unnecessary spending. This is a good trick to help you not to fall for quick impulse purchases.

3. Don’t Just Spend More When You Earn More

Some months can be better than others for your finances. You may get some extra bucks from your work as a bonus or get some additional cash inflow to your budget. This does not mean you make extra effort to find a way and spend it. If you do have a situation with an increase in income you should ideally:

Channel Additional Earnings Wisely: When blessed with bonuses or raises, lean towards saving or investing the money instead of splurging.

Maintain Your Budget: Stop looking for ways to spend the extra cash. If your previous budget led you to a comfortable lifestyle, stick with what worked. Make use of the extra cash for a better cause such as paying off debt.

4. Avoid Big Debts

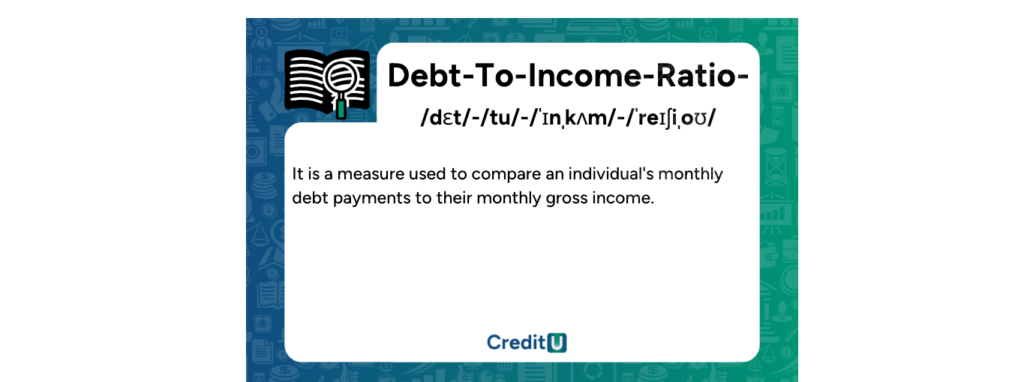

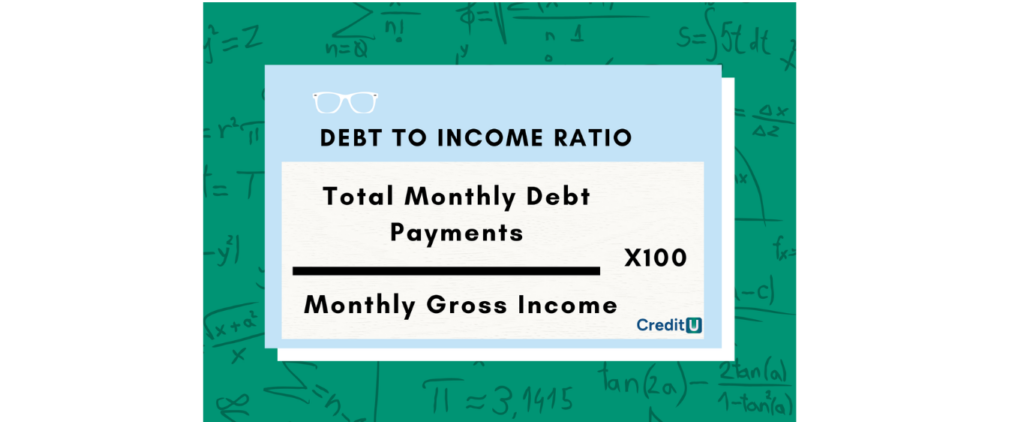

Debts, especially those incurring hefty interests like credit card dues, can be detrimental to the success of your financial situation. Make sure your budget accommodates your existing credit card debt. Try and avoid taking more loans to cover the existing debt. Speak with financial experts to find the best strategy. Maintaining a healthy debt to income ratio is the key to success.

It’s often used by lenders, especially mortgage lenders, to assess a person’s ability to manage monthly payments and repay debts.

For example, if someone has a total monthly debt payment of $1,000 and a monthly gross income of $4,000, their DTI would be:

DTI=(1,000/4,000)×100=25%

A lower DTI percentage indicates a favorable balance between debt and income. Generally, lenders consider lower DTI ratios as indicative of a borrower being less risky. However, what’s considered a “good” or “high” DTI can vary depending on the lender and the type of loan.

When it comes to living below your means make sure you

Settle Balances Promptly: Evade accumulating interest by clearing credit card balances monthly. Should you be in debt, come up with a plan to pare it down swiftly.

Reevaluate Loan Terms: For those burdened with high-interest loans, exploring refinancing to clinch a more favorable interest rate can be beneficial.

5. Be Smart with Money

Frugality isn’t synonymous with penny-pinching; it’s about deriving maximum value from every expenditure. Find ways to use your money wisely. Make informed money decisions. Frugal is not stingy. Some basic things you can do to help this process are:

Opt-in for Pre-owned: Numerous items, encompassing vehicles, gadgets, or furnishings, can be procured second-hand, offering significant savings. Thrift stores, Facebook market place are good places to start.

Join the DIY Club: Be it minor home fixes or grooming routines, personal efforts can translate to substantial monetary savings. Figure out what you can do yourself vs what you absolutely need to spend money buying.

6.Have an Emergency Fund Set Up

Life’s unpredictable nature means unforeseen expenses can arise. A buffer can prevent these from derailing your financial train. Ideally a safety net should cover 3-6 months of your household expenses.

Commence with Modest Goals: Initially, at least target a cushion of $1,000. Gradually, aim to build up a fund capable of covering 3-6 months of your household expenses.

Keep It Ready: Put this money where you can use it easily if needed, like in a regular bank account.

7. Invest in Personal Growth

Keep continuous tabs on your finances and find ways to grow. Look for investment avenues, savings strategies that work for you. Work with financial experts to get the help you need.

Cultivate Continuous Learning: Allocate resources to materials or events, like books or workshops, that facilitate personal and professional evolution.

Health is Wealth: Taking proactive steps to maintain good health today can curtail hefty medical expenditures down the line.

Living within, or better yet, below your means transcends mere frugality. It’s an endeavor to sculpt a life where long-term prosperity and well-being eclipse fleeting indulgences. With dedication and strategic planning, transitioning to this commendable paradigm is within everyone’s reach.

What Can CreditU Do For You?

CreditU is a finance app that can revolutionize the way you manage your money, offering you a variety of tools that can help you stay within your budget, live below your means, and achieve your financial goals. By tracking your expenses, you can identify areas where you might be overspending and make the necessary adjustments to your lifestyle. This can help you live below your means, which can lead to long-term financial stability and success.

One of the most powerful features of CreditU is the ability to set financial goals and track your progress towards achieving them. Whether you want to save for a down payment on a house, pay off debt, or simply build up your savings account, CreditU can help you stay on track and make progress towards your goals.

CreditU also offers financial education resources tailored to your unique financial goals. Whether you’re just starting out or you’re a seasoned saver, CreditU can provide you with the information you need to make informed decisions about your money. From budgeting basics to strategies on how to lower your expenses, CreditU has you covered.

CreditU is a powerful tool that can help with living below your means, take control of your finances, and achieve your financial goals. By tracking your expenses, setting budgets, and staying living below your means, you can build a strong foundation for long-term financial success. With CreditU, the sky’s the limit! Click here to learn more.

Key Insights – Tips For Living Below Your Means

1. Living below means is a lifestyle that you need to adopt.

2. It’s easy to confuse frugality with stinginess, but they’re fundamentally different in intent and practice.

3. Do not fall for the myths about living below your means.

4. Think of living below your means as an investment in your future rather than a chore.

Last Updated on January 11, 2024 by Dilini Dias Dahanayake